Tax Lien Properties In California

Tax Lien Properties In California - Buying tax liens in california is not possible since california is a tax deed state. California, currently has 37,363 tax liens available as of january 7. The auction is conducted by the county tax collector, and the. Properties become subject to the county tax collector’s power to sell because of a default in the payment of property taxes for five or more. When a homeowner falls delinquent on property taxes,. Refer to section 3712 of the california revenue and taxation code regarding liens and encumbrances on a property sold at a.

Buying tax liens in california is not possible since california is a tax deed state. The auction is conducted by the county tax collector, and the. California, currently has 37,363 tax liens available as of january 7. When a homeowner falls delinquent on property taxes,. Refer to section 3712 of the california revenue and taxation code regarding liens and encumbrances on a property sold at a. Properties become subject to the county tax collector’s power to sell because of a default in the payment of property taxes for five or more.

Buying tax liens in california is not possible since california is a tax deed state. Refer to section 3712 of the california revenue and taxation code regarding liens and encumbrances on a property sold at a. The auction is conducted by the county tax collector, and the. Properties become subject to the county tax collector’s power to sell because of a default in the payment of property taxes for five or more. California, currently has 37,363 tax liens available as of january 7. When a homeowner falls delinquent on property taxes,.

Tax Lien Sale Download Free PDF Tax Lien Taxes

Buying tax liens in california is not possible since california is a tax deed state. California, currently has 37,363 tax liens available as of january 7. Refer to section 3712 of the california revenue and taxation code regarding liens and encumbrances on a property sold at a. The auction is conducted by the county tax collector, and the. When a.

Tax Lien Properties Texas Real Estate Tax Lien Investing for Beginners

Properties become subject to the county tax collector’s power to sell because of a default in the payment of property taxes for five or more. The auction is conducted by the county tax collector, and the. Refer to section 3712 of the california revenue and taxation code regarding liens and encumbrances on a property sold at a. When a homeowner.

Free list of Tax Lien Properties, Getting More of What You Want

Properties become subject to the county tax collector’s power to sell because of a default in the payment of property taxes for five or more. California, currently has 37,363 tax liens available as of january 7. The auction is conducted by the county tax collector, and the. Refer to section 3712 of the california revenue and taxation code regarding liens.

Exploring the Landscape of Tax Lien Properties A Comprehensive

Buying tax liens in california is not possible since california is a tax deed state. When a homeowner falls delinquent on property taxes,. California, currently has 37,363 tax liens available as of january 7. Properties become subject to the county tax collector’s power to sell because of a default in the payment of property taxes for five or more. The.

The Demand for Tax Lien Properties Tax, Demand, Property

California, currently has 37,363 tax liens available as of january 7. The auction is conducted by the county tax collector, and the. When a homeowner falls delinquent on property taxes,. Properties become subject to the county tax collector’s power to sell because of a default in the payment of property taxes for five or more. Buying tax liens in california.

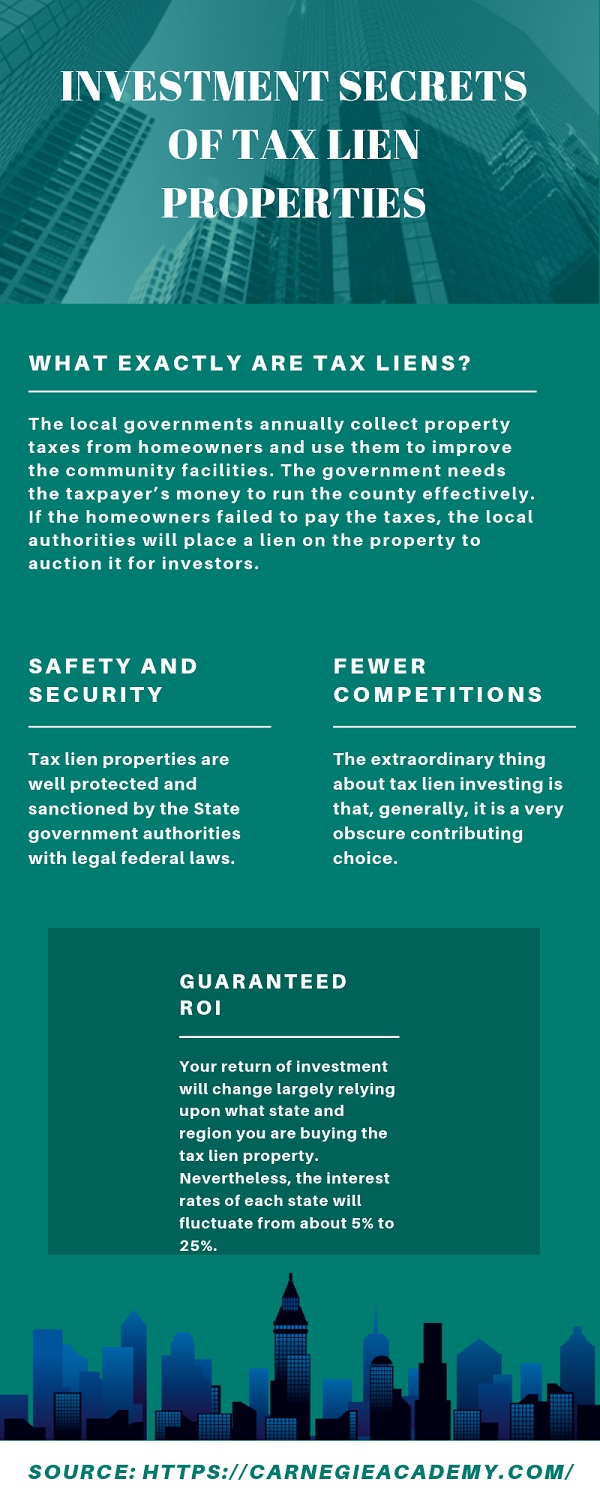

Investment Secrets of Tax Lien Properties Latest Infographics

When a homeowner falls delinquent on property taxes,. Properties become subject to the county tax collector’s power to sell because of a default in the payment of property taxes for five or more. The auction is conducted by the county tax collector, and the. Buying tax liens in california is not possible since california is a tax deed state. California,.

How to Find and Invest in Tax Lien Properties? Latest Infographics

When a homeowner falls delinquent on property taxes,. Buying tax liens in california is not possible since california is a tax deed state. The auction is conducted by the county tax collector, and the. California, currently has 37,363 tax liens available as of january 7. Properties become subject to the county tax collector’s power to sell because of a default.

Tax Lien Properties In Montana Brightside Tax Relief

California, currently has 37,363 tax liens available as of january 7. When a homeowner falls delinquent on property taxes,. The auction is conducted by the county tax collector, and the. Properties become subject to the county tax collector’s power to sell because of a default in the payment of property taxes for five or more. Buying tax liens in california.

Tax Lien Properties California Real Estate Tax Lien Investing for

Properties become subject to the county tax collector’s power to sell because of a default in the payment of property taxes for five or more. The auction is conducted by the county tax collector, and the. California, currently has 37,363 tax liens available as of january 7. When a homeowner falls delinquent on property taxes,. Refer to section 3712 of.

How to Find Tax Lien Properties Unlocking the Secret World of

Buying tax liens in california is not possible since california is a tax deed state. Refer to section 3712 of the california revenue and taxation code regarding liens and encumbrances on a property sold at a. The auction is conducted by the county tax collector, and the. Properties become subject to the county tax collector’s power to sell because of.

Refer To Section 3712 Of The California Revenue And Taxation Code Regarding Liens And Encumbrances On A Property Sold At A.

Buying tax liens in california is not possible since california is a tax deed state. California, currently has 37,363 tax liens available as of january 7. Properties become subject to the county tax collector’s power to sell because of a default in the payment of property taxes for five or more. The auction is conducted by the county tax collector, and the.