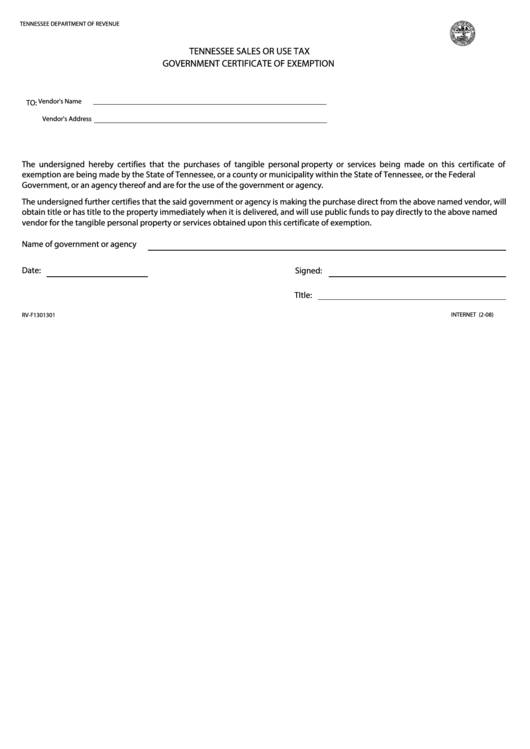

Tennessee Sales Tax Exempt Form

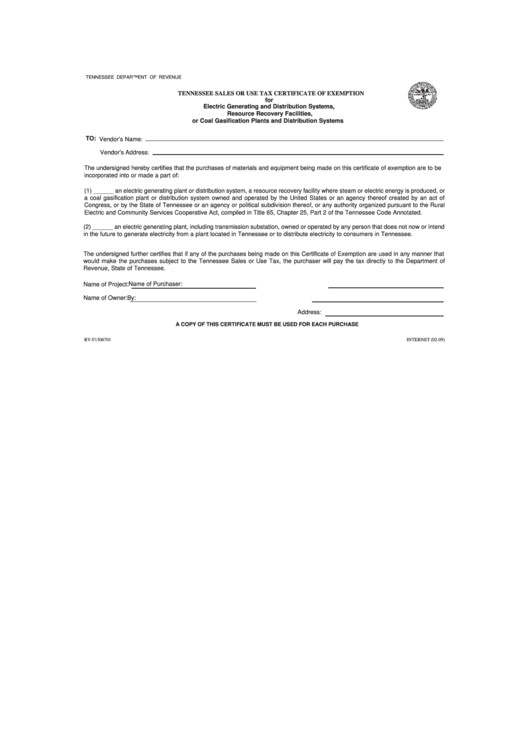

Tennessee Sales Tax Exempt Form - To understand the scope of exemptions and reduced rates, the purchases that remain taxable, and how to effectively administer these tax. Application for research and development. If an organization qualifies as exempt from sales and use tax under tenn. Purchasers must provide a new resale or exemption certificate if there are changes in the purchaser's business (e.g.,. Application for broadband infrastructure sales and use tax exemption; This application for registration is to be used to register your organization for exemption from the tennessee sales or use.

Application for research and development. To understand the scope of exemptions and reduced rates, the purchases that remain taxable, and how to effectively administer these tax. This application for registration is to be used to register your organization for exemption from the tennessee sales or use. If an organization qualifies as exempt from sales and use tax under tenn. Purchasers must provide a new resale or exemption certificate if there are changes in the purchaser's business (e.g.,. Application for broadband infrastructure sales and use tax exemption;

To understand the scope of exemptions and reduced rates, the purchases that remain taxable, and how to effectively administer these tax. Application for research and development. If an organization qualifies as exempt from sales and use tax under tenn. Application for broadband infrastructure sales and use tax exemption; Purchasers must provide a new resale or exemption certificate if there are changes in the purchaser's business (e.g.,. This application for registration is to be used to register your organization for exemption from the tennessee sales or use.

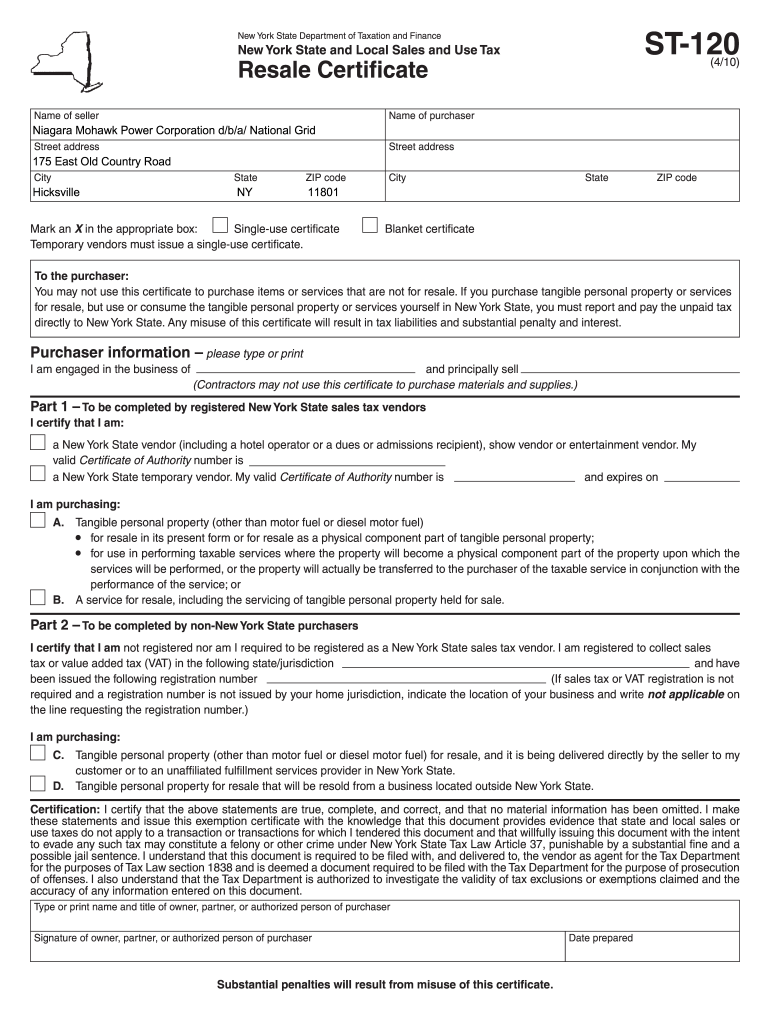

Tennessee Sales Tax Complete with ease airSlate SignNow

To understand the scope of exemptions and reduced rates, the purchases that remain taxable, and how to effectively administer these tax. Application for broadband infrastructure sales and use tax exemption; If an organization qualifies as exempt from sales and use tax under tenn. Purchasers must provide a new resale or exemption certificate if there are changes in the purchaser's business.

Tn Sales Tax Exemption Form

Application for broadband infrastructure sales and use tax exemption; This application for registration is to be used to register your organization for exemption from the tennessee sales or use. Purchasers must provide a new resale or exemption certificate if there are changes in the purchaser's business (e.g.,. To understand the scope of exemptions and reduced rates, the purchases that remain.

Blanket Certificate Of Exemption Form Fill Online, Printable

Application for research and development. Purchasers must provide a new resale or exemption certificate if there are changes in the purchaser's business (e.g.,. Application for broadband infrastructure sales and use tax exemption; To understand the scope of exemptions and reduced rates, the purchases that remain taxable, and how to effectively administer these tax. This application for registration is to be.

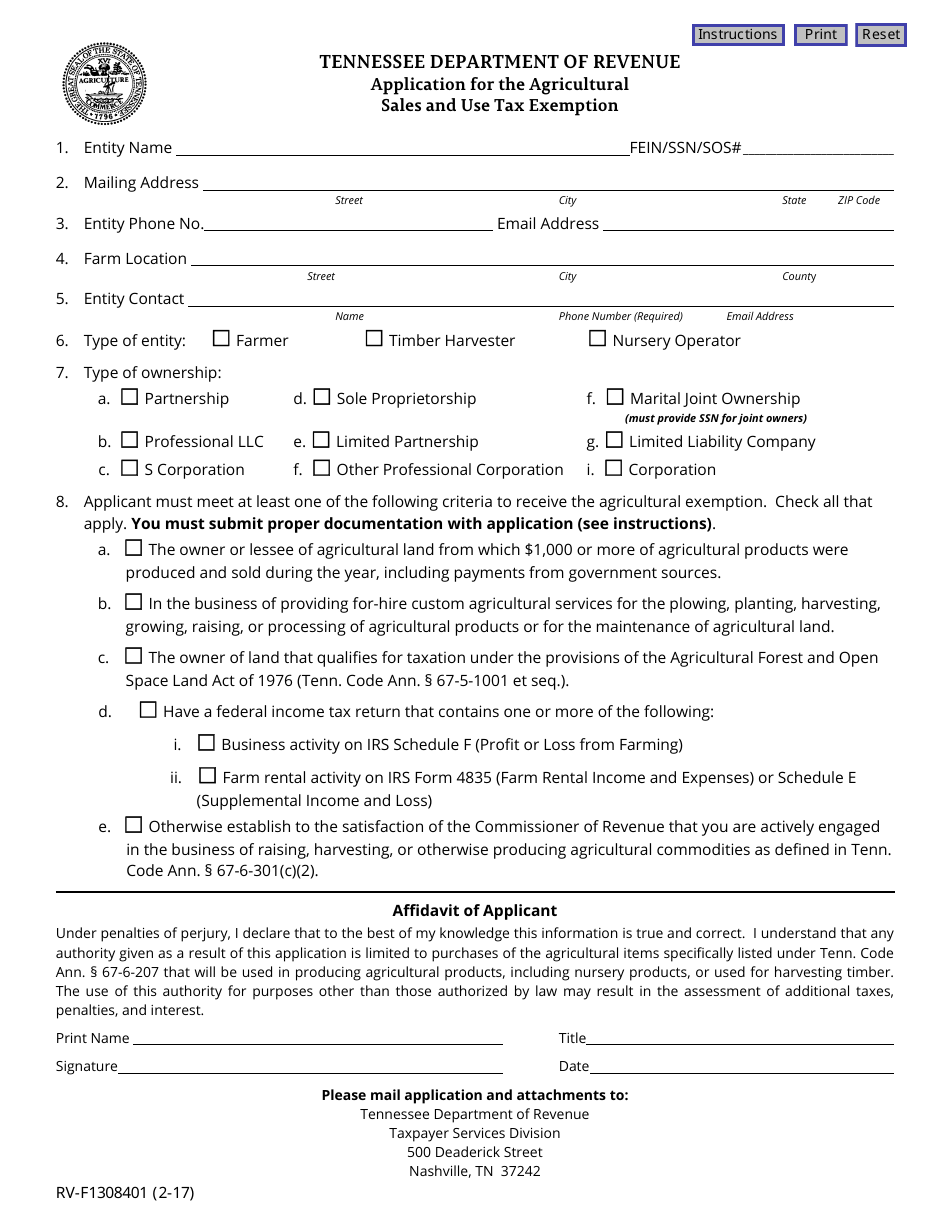

Form RVF1308401 Fill Out, Sign Online and Download Fillable PDF

Application for research and development. To understand the scope of exemptions and reduced rates, the purchases that remain taxable, and how to effectively administer these tax. Purchasers must provide a new resale or exemption certificate if there are changes in the purchaser's business (e.g.,. Application for broadband infrastructure sales and use tax exemption; This application for registration is to be.

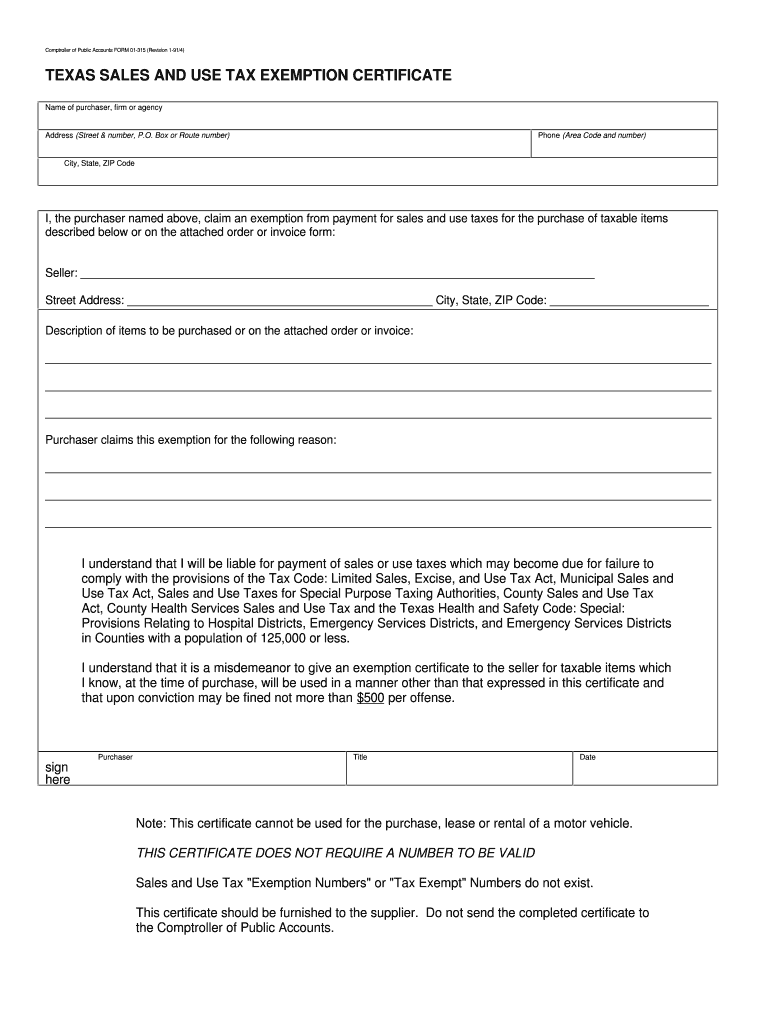

Texas Fillable Tax Exemption Form Fill Out And Sign Printable PDF

To understand the scope of exemptions and reduced rates, the purchases that remain taxable, and how to effectively administer these tax. Application for broadband infrastructure sales and use tax exemption; Application for research and development. If an organization qualifies as exempt from sales and use tax under tenn. This application for registration is to be used to register your organization.

Louisiana Resale Certificate PDF Complete with ease airSlate SignNow

Application for broadband infrastructure sales and use tax exemption; Application for research and development. This application for registration is to be used to register your organization for exemption from the tennessee sales or use. To understand the scope of exemptions and reduced rates, the purchases that remain taxable, and how to effectively administer these tax. If an organization qualifies as.

Tennessee State Tax Withholding Form

Application for research and development. Application for broadband infrastructure sales and use tax exemption; To understand the scope of exemptions and reduced rates, the purchases that remain taxable, and how to effectively administer these tax. If an organization qualifies as exempt from sales and use tax under tenn. This application for registration is to be used to register your organization.

Tax Exempt Form Fill Online, Printable, Fillable, Blank pdfFiller

To understand the scope of exemptions and reduced rates, the purchases that remain taxable, and how to effectively administer these tax. Purchasers must provide a new resale or exemption certificate if there are changes in the purchaser's business (e.g.,. If an organization qualifies as exempt from sales and use tax under tenn. Application for broadband infrastructure sales and use tax.

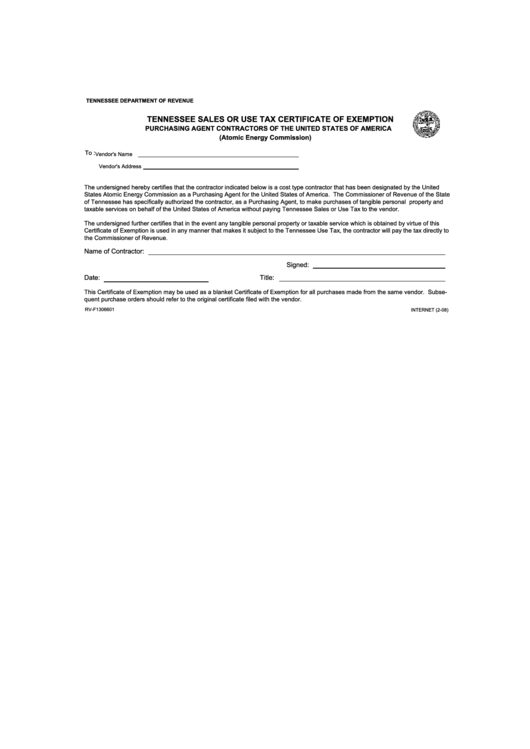

Form RvF1306701 Tennessee Sales Or Use Tax Certificate Of Exemption

To understand the scope of exemptions and reduced rates, the purchases that remain taxable, and how to effectively administer these tax. This application for registration is to be used to register your organization for exemption from the tennessee sales or use. Application for broadband infrastructure sales and use tax exemption; Application for research and development. If an organization qualifies as.

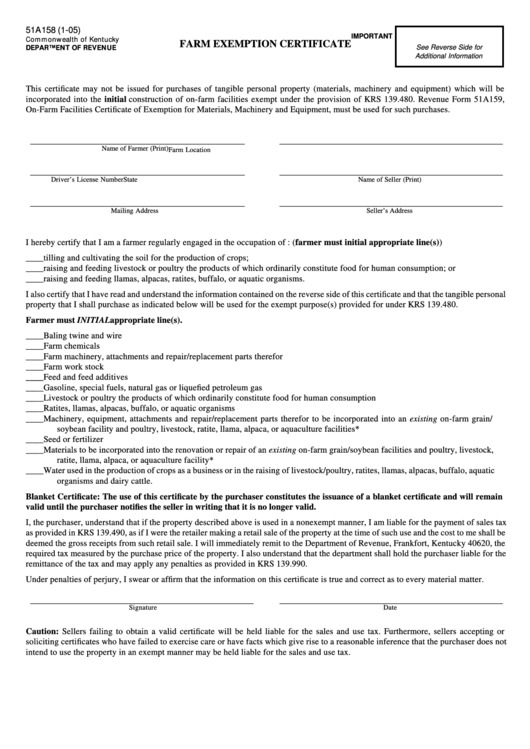

Kentucky Sales Tax Farm Exemption Form Fill Online Printable

To understand the scope of exemptions and reduced rates, the purchases that remain taxable, and how to effectively administer these tax. Application for broadband infrastructure sales and use tax exemption; This application for registration is to be used to register your organization for exemption from the tennessee sales or use. If an organization qualifies as exempt from sales and use.

This Application For Registration Is To Be Used To Register Your Organization For Exemption From The Tennessee Sales Or Use.

Application for research and development. If an organization qualifies as exempt from sales and use tax under tenn. To understand the scope of exemptions and reduced rates, the purchases that remain taxable, and how to effectively administer these tax. Purchasers must provide a new resale or exemption certificate if there are changes in the purchaser's business (e.g.,.