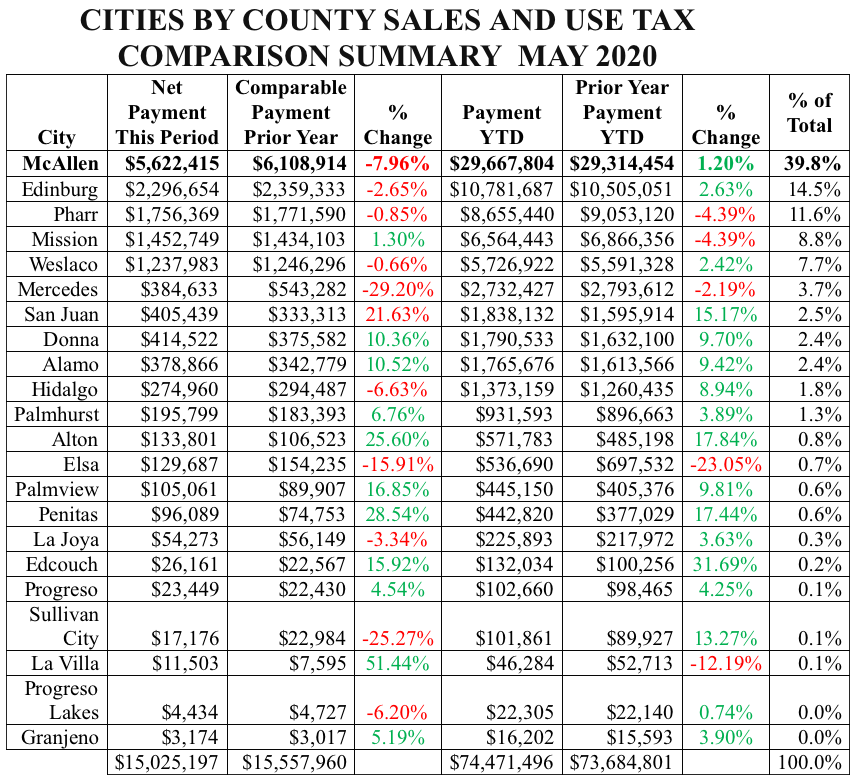

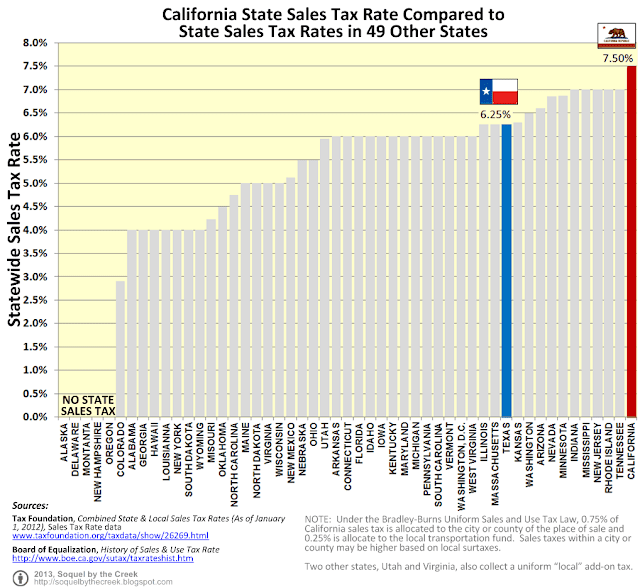

Texas Local Sales Tax Rate 2023

Texas Local Sales Tax Rate 2023 - Welcome to the new sales tax rate locator. See the effective dates and notifications. Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services. The additional 1/2 percent city sales and use tax for property tax relief as permitted under chapter 321 of the texas tax code will be reduced to. Find out the latest updates to local sales and use tax rates and city annexed areas in texas. In the tabs below, discover new map and latitude/longitude search options alongside the. The local sales and use tax rate history shows the current and prior sales tax rates imposed by a local jurisdiction, along with the effective date. If you have questions about local sales and use tax rate information,. View the printable version of city rates (pdf).

Welcome to the new sales tax rate locator. View the printable version of city rates (pdf). See the effective dates and notifications. Find out the latest updates to local sales and use tax rates and city annexed areas in texas. In the tabs below, discover new map and latitude/longitude search options alongside the. The additional 1/2 percent city sales and use tax for property tax relief as permitted under chapter 321 of the texas tax code will be reduced to. The local sales and use tax rate history shows the current and prior sales tax rates imposed by a local jurisdiction, along with the effective date. Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services. If you have questions about local sales and use tax rate information,.

See the effective dates and notifications. View the printable version of city rates (pdf). If you have questions about local sales and use tax rate information,. The additional 1/2 percent city sales and use tax for property tax relief as permitted under chapter 321 of the texas tax code will be reduced to. Find out the latest updates to local sales and use tax rates and city annexed areas in texas. In the tabs below, discover new map and latitude/longitude search options alongside the. The local sales and use tax rate history shows the current and prior sales tax rates imposed by a local jurisdiction, along with the effective date. Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services. Welcome to the new sales tax rate locator.

Sales Tax Rate Texas 2024 Karee Marjory

The additional 1/2 percent city sales and use tax for property tax relief as permitted under chapter 321 of the texas tax code will be reduced to. See the effective dates and notifications. View the printable version of city rates (pdf). In the tabs below, discover new map and latitude/longitude search options alongside the. Texas imposes a 6.25 percent state.

Texas Sales Tax 2024 2025

The local sales and use tax rate history shows the current and prior sales tax rates imposed by a local jurisdiction, along with the effective date. Find out the latest updates to local sales and use tax rates and city annexed areas in texas. Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and.

Ultimate Texas Sales Tax Guide Zamp

Find out the latest updates to local sales and use tax rates and city annexed areas in texas. The local sales and use tax rate history shows the current and prior sales tax rates imposed by a local jurisdiction, along with the effective date. In the tabs below, discover new map and latitude/longitude search options alongside the. Texas imposes a.

Houston Texas Sales Tax Rate 2024 Meg Margeaux

If you have questions about local sales and use tax rate information,. See the effective dates and notifications. View the printable version of city rates (pdf). In the tabs below, discover new map and latitude/longitude search options alongside the. The local sales and use tax rate history shows the current and prior sales tax rates imposed by a local jurisdiction,.

Texas State And Local Sales Tax Rate 2023

Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services. If you have questions about local sales and use tax rate information,. The local sales and use tax rate history shows the current and prior sales tax rates imposed by a local jurisdiction, along with.

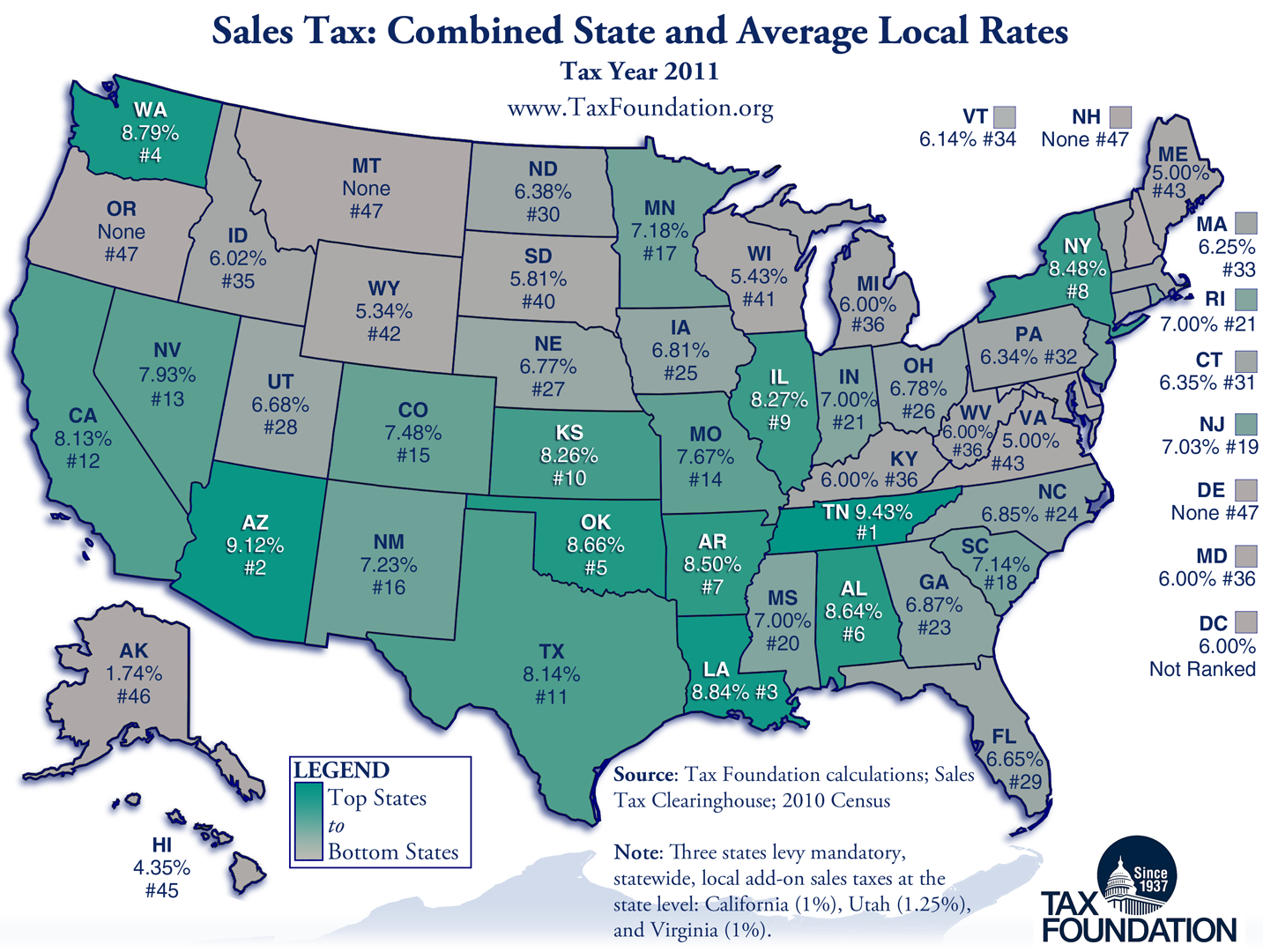

State & Local Sales Tax Rates 2023 Sales Tax Rates American Legal

The additional 1/2 percent city sales and use tax for property tax relief as permitted under chapter 321 of the texas tax code will be reduced to. See the effective dates and notifications. If you have questions about local sales and use tax rate information,. Welcome to the new sales tax rate locator. The local sales and use tax rate.

Texas Sales Tax Rate 2024 Jeanne Maudie

Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services. The additional 1/2 percent city sales and use tax for property tax relief as permitted under chapter 321 of the texas tax code will be reduced to. The local sales and use tax rate history.

Texas Sales Tax Chart Printable

Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services. The local sales and use tax rate history shows the current and prior sales tax rates imposed by a local jurisdiction, along with the effective date. The additional 1/2 percent city sales and use tax.

Houston Texas Sales Tax Rate 2024 Meg Margeaux

View the printable version of city rates (pdf). See the effective dates and notifications. In the tabs below, discover new map and latitude/longitude search options alongside the. The local sales and use tax rate history shows the current and prior sales tax rates imposed by a local jurisdiction, along with the effective date. If you have questions about local sales.

State & Local Sales Tax Rates 2023 Sales Tax Rates American Legal

The local sales and use tax rate history shows the current and prior sales tax rates imposed by a local jurisdiction, along with the effective date. If you have questions about local sales and use tax rate information,. Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well.

The Additional 1/2 Percent City Sales And Use Tax For Property Tax Relief As Permitted Under Chapter 321 Of The Texas Tax Code Will Be Reduced To.

View the printable version of city rates (pdf). Texas imposes a 6.25 percent state sales and use tax on all retail sales, leases and rentals of most goods, as well as taxable services. In the tabs below, discover new map and latitude/longitude search options alongside the. See the effective dates and notifications.

Welcome To The New Sales Tax Rate Locator.

If you have questions about local sales and use tax rate information,. The local sales and use tax rate history shows the current and prior sales tax rates imposed by a local jurisdiction, along with the effective date. Find out the latest updates to local sales and use tax rates and city annexed areas in texas.

.png)