Texas Tax Liens

Texas Tax Liens - The mhd tax lien database system is designed to allow taxing entities the ability to release their own liens as well as the liens for the entities. Tax liens and personal liability. Please be aware that a tax. Tax liability secured by lien. Learn how to pay your property taxes in texas, including payment options, deadline, receipts and waivers. (a) all taxes, fines, interest, and penalties due by a person to the state under this title are secured by a lien. State law requires that all past due taxes, fines, interest and penalties owed to the state must be secured by a lien. Find out what to do if you don't receive. Cause numbers are noted as. Sales results by month are posted on the delinquent tax sales link at the bottom of this page.

Sales results by month are posted on the delinquent tax sales link at the bottom of this page. Tax liens and personal liability. Cause numbers are noted as. Please be aware that a tax. State law requires that all past due taxes, fines, interest and penalties owed to the state must be secured by a lien. Find out what to do if you don't receive. Tax liability secured by lien. (a) all taxes, fines, interest, and penalties due by a person to the state under this title are secured by a lien. The mhd tax lien database system is designed to allow taxing entities the ability to release their own liens as well as the liens for the entities. (a) on january 1 of each year, a tax lien attaches to property to.

Tax liability secured by lien. Find out what to do if you don't receive. Learn how to pay your property taxes in texas, including payment options, deadline, receipts and waivers. State law requires that all past due taxes, fines, interest and penalties owed to the state must be secured by a lien. Tax liens and personal liability. Cause numbers are noted as. (a) all taxes, fines, interest, and penalties due by a person to the state under this title are secured by a lien. The mhd tax lien database system is designed to allow taxing entities the ability to release their own liens as well as the liens for the entities. Please be aware that a tax. Sales results by month are posted on the delinquent tax sales link at the bottom of this page.

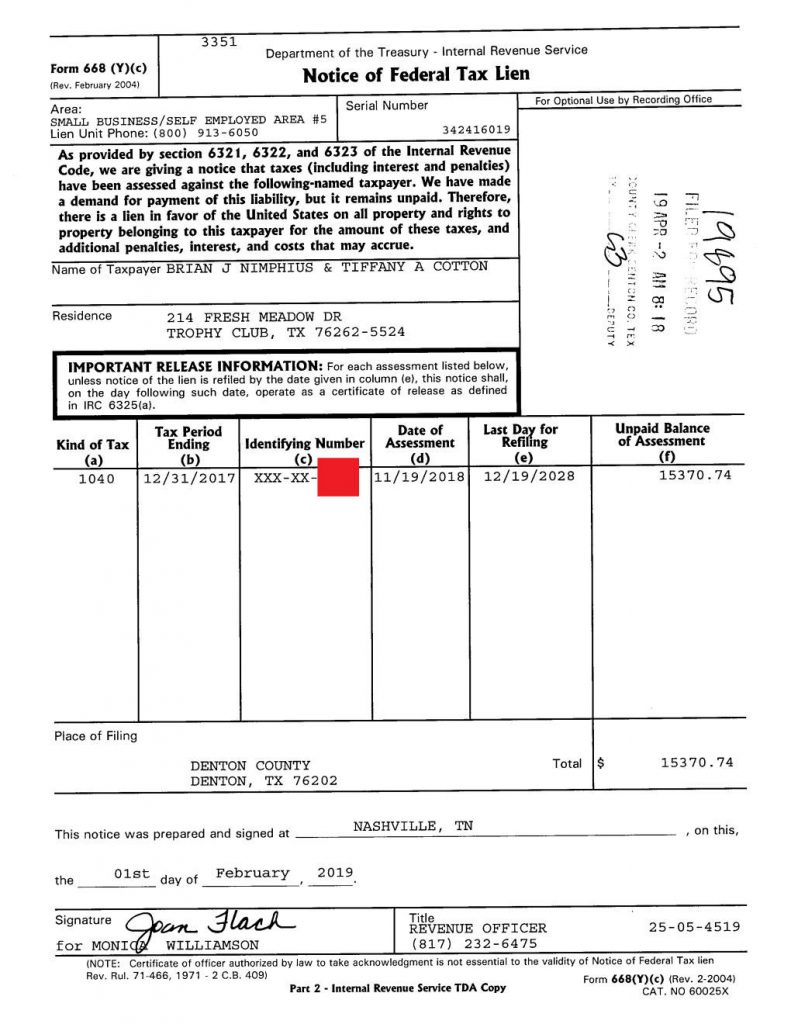

Council Candidate has 50k in Tax Liens Trophy Club Journal

Sales results by month are posted on the delinquent tax sales link at the bottom of this page. (a) all taxes, fines, interest, and penalties due by a person to the state under this title are secured by a lien. Tax liability secured by lien. The mhd tax lien database system is designed to allow taxing entities the ability to.

Looking to buy Tax liens in Texas. Best way to do? Tax, Looking to

Please be aware that a tax. Sales results by month are posted on the delinquent tax sales link at the bottom of this page. The mhd tax lien database system is designed to allow taxing entities the ability to release their own liens as well as the liens for the entities. State law requires that all past due taxes, fines,.

Tax Lien We Buy Texas City Houses

Tax liability secured by lien. Learn how to pay your property taxes in texas, including payment options, deadline, receipts and waivers. (a) on january 1 of each year, a tax lien attaches to property to. The mhd tax lien database system is designed to allow taxing entities the ability to release their own liens as well as the liens for.

What Is A Tax Lien? Atlanta Tax Lawyer Alyssa Maloof Whatley

State law requires that all past due taxes, fines, interest and penalties owed to the state must be secured by a lien. Please be aware that a tax. Learn how to pay your property taxes in texas, including payment options, deadline, receipts and waivers. Tax liability secured by lien. Find out what to do if you don't receive.

Federal Tax Liens Providence Title Company of Texas Providence

Find out what to do if you don't receive. State law requires that all past due taxes, fines, interest and penalties owed to the state must be secured by a lien. Cause numbers are noted as. Sales results by month are posted on the delinquent tax sales link at the bottom of this page. The mhd tax lien database system.

Tax Liens What You Need to Know Cumberland Law Group

Learn how to pay your property taxes in texas, including payment options, deadline, receipts and waivers. Tax liens and personal liability. Tax liability secured by lien. Sales results by month are posted on the delinquent tax sales link at the bottom of this page. Cause numbers are noted as.

Investing In Tax Liens Alts.co

(a) all taxes, fines, interest, and penalties due by a person to the state under this title are secured by a lien. Cause numbers are noted as. Please be aware that a tax. State law requires that all past due taxes, fines, interest and penalties owed to the state must be secured by a lien. Tax liens and personal liability.

Tax Liens An Overview CheckBook IRA LLC

Find out what to do if you don't receive. Cause numbers are noted as. Tax liens and personal liability. Please be aware that a tax. Learn how to pay your property taxes in texas, including payment options, deadline, receipts and waivers.

Tax Liens and Deeds Live Class Pips Path

(a) all taxes, fines, interest, and penalties due by a person to the state under this title are secured by a lien. Find out what to do if you don't receive. Tax liability secured by lien. State law requires that all past due taxes, fines, interest and penalties owed to the state must be secured by a lien. The mhd.

TEXAS TAX LIEN SALES GUIDE

The mhd tax lien database system is designed to allow taxing entities the ability to release their own liens as well as the liens for the entities. State law requires that all past due taxes, fines, interest and penalties owed to the state must be secured by a lien. Find out what to do if you don't receive. Tax liability.

Learn How To Pay Your Property Taxes In Texas, Including Payment Options, Deadline, Receipts And Waivers.

Find out what to do if you don't receive. (a) on january 1 of each year, a tax lien attaches to property to. (a) all taxes, fines, interest, and penalties due by a person to the state under this title are secured by a lien. Sales results by month are posted on the delinquent tax sales link at the bottom of this page.

Cause Numbers Are Noted As.

Tax liens and personal liability. The mhd tax lien database system is designed to allow taxing entities the ability to release their own liens as well as the liens for the entities. Please be aware that a tax. Tax liability secured by lien.