What Is A Form 2210

What Is A Form 2210 - Irs form 2210, underpayment of estimated tax by individuals, estates, and trusts, is a tax document that some taxpayers are required to. Attach form 2210 and a statement to your return explaining the reasons you were unable to meet the estimated tax requirements and the time. Form 2210 is used to calculate and pay the penalty for underpaying your estimated tax by individuals, estates, and trusts.

Attach form 2210 and a statement to your return explaining the reasons you were unable to meet the estimated tax requirements and the time. Form 2210 is used to calculate and pay the penalty for underpaying your estimated tax by individuals, estates, and trusts. Irs form 2210, underpayment of estimated tax by individuals, estates, and trusts, is a tax document that some taxpayers are required to.

Attach form 2210 and a statement to your return explaining the reasons you were unable to meet the estimated tax requirements and the time. Form 2210 is used to calculate and pay the penalty for underpaying your estimated tax by individuals, estates, and trusts. Irs form 2210, underpayment of estimated tax by individuals, estates, and trusts, is a tax document that some taxpayers are required to.

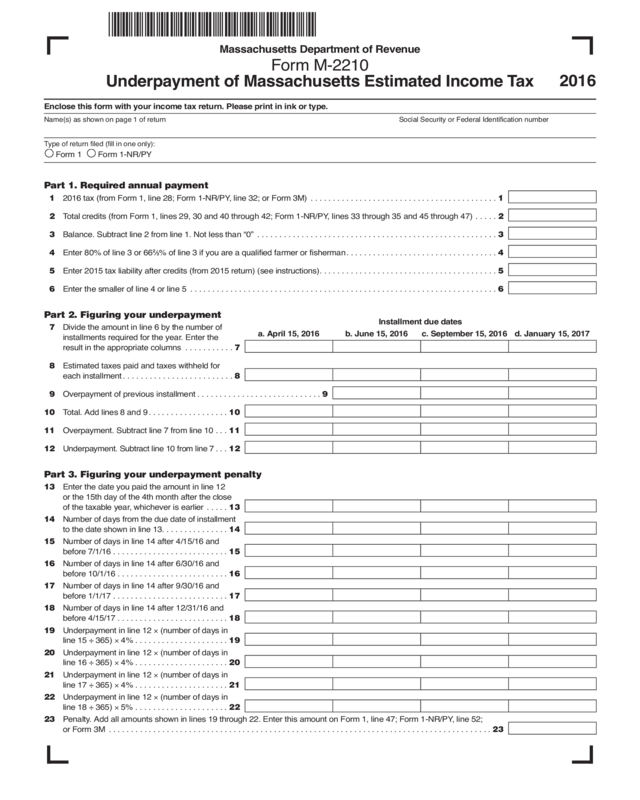

Form M2210 Edit, Fill, Sign Online Handypdf

Form 2210 is used to calculate and pay the penalty for underpaying your estimated tax by individuals, estates, and trusts. Irs form 2210, underpayment of estimated tax by individuals, estates, and trusts, is a tax document that some taxpayers are required to. Attach form 2210 and a statement to your return explaining the reasons you were unable to meet the.

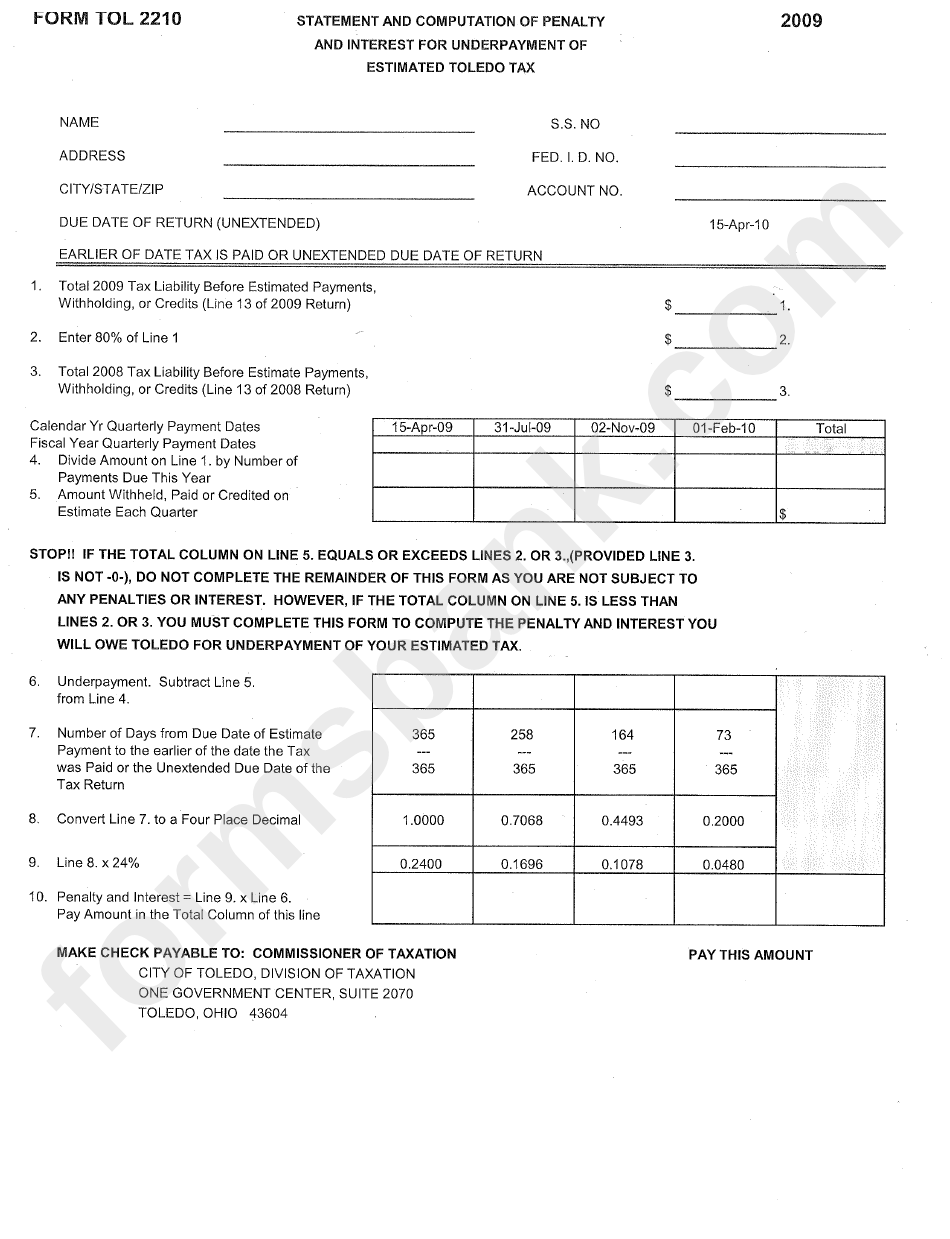

Form Tol 2210 Statement And Computation Of Penalty And Interest

Form 2210 is used to calculate and pay the penalty for underpaying your estimated tax by individuals, estates, and trusts. Irs form 2210, underpayment of estimated tax by individuals, estates, and trusts, is a tax document that some taxpayers are required to. Attach form 2210 and a statement to your return explaining the reasons you were unable to meet the.

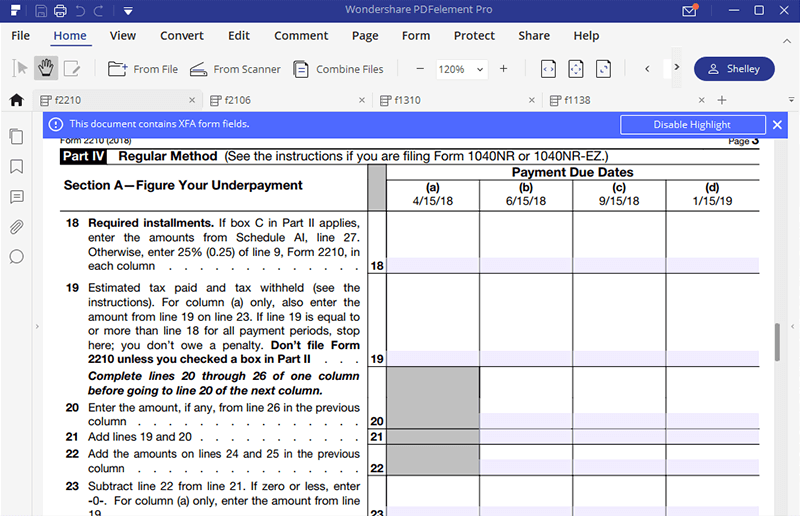

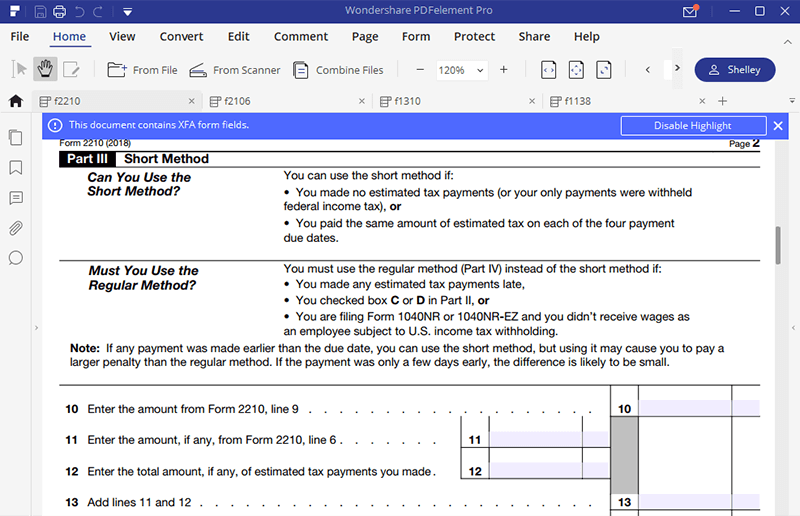

IRS Form 2210Fill it with the Best Form Filler

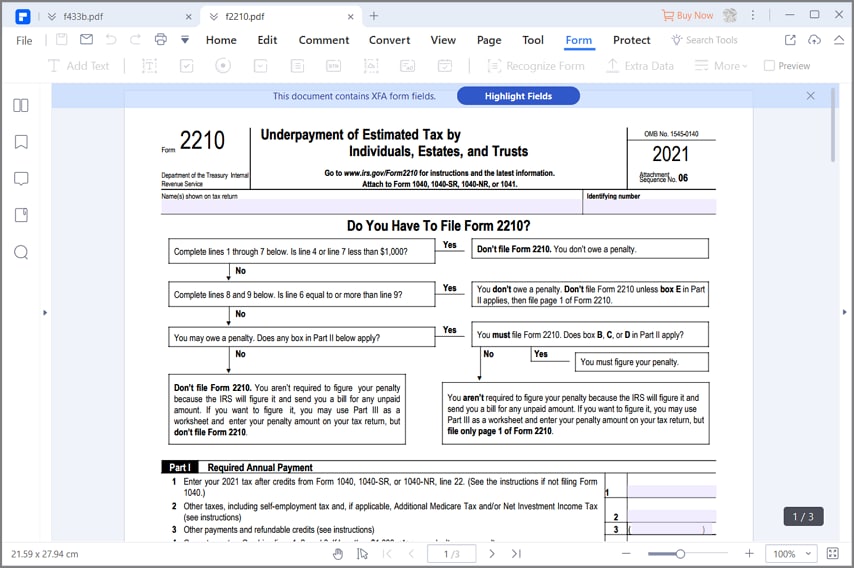

Irs form 2210, underpayment of estimated tax by individuals, estates, and trusts, is a tax document that some taxpayers are required to. Form 2210 is used to calculate and pay the penalty for underpaying your estimated tax by individuals, estates, and trusts. Attach form 2210 and a statement to your return explaining the reasons you were unable to meet the.

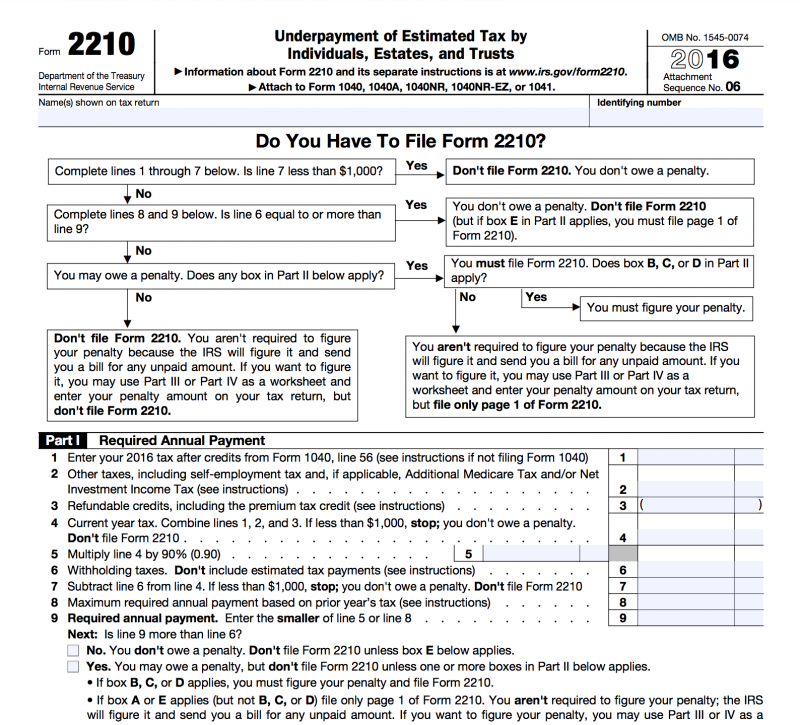

Irs Form 2210 For 2023 Printable Forms Free Online

Attach form 2210 and a statement to your return explaining the reasons you were unable to meet the estimated tax requirements and the time. Irs form 2210, underpayment of estimated tax by individuals, estates, and trusts, is a tax document that some taxpayers are required to. Form 2210 is used to calculate and pay the penalty for underpaying your estimated.

IRS Form 2210 A Guide to Underpayment of Tax

Irs form 2210, underpayment of estimated tax by individuals, estates, and trusts, is a tax document that some taxpayers are required to. Form 2210 is used to calculate and pay the penalty for underpaying your estimated tax by individuals, estates, and trusts. Attach form 2210 and a statement to your return explaining the reasons you were unable to meet the.

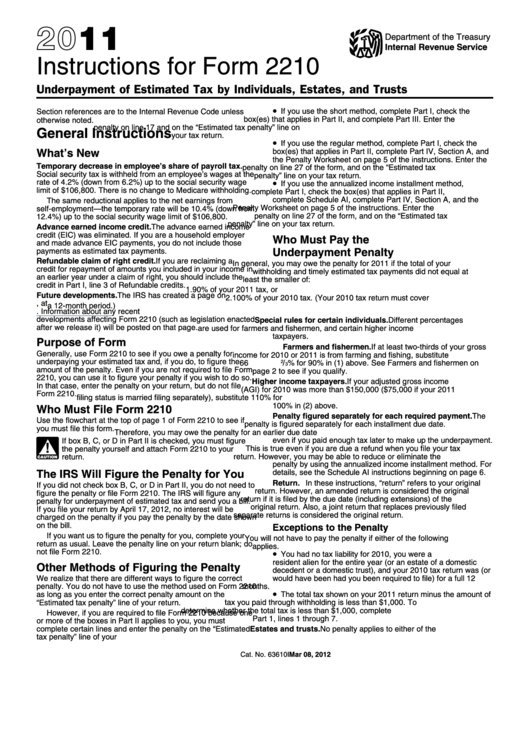

Instructions For Form 2210 Underpayment Of Estimated Tax By

Attach form 2210 and a statement to your return explaining the reasons you were unable to meet the estimated tax requirements and the time. Form 2210 is used to calculate and pay the penalty for underpaying your estimated tax by individuals, estates, and trusts. Irs form 2210, underpayment of estimated tax by individuals, estates, and trusts, is a tax document.

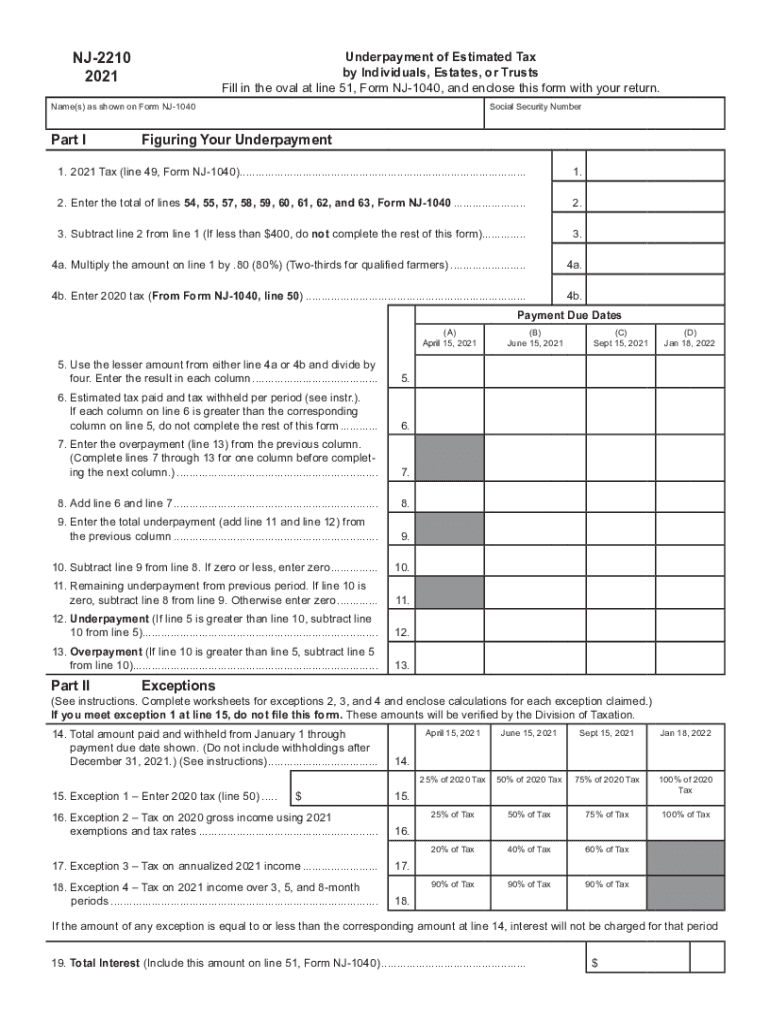

Nj2210 Complete with ease airSlate SignNow

Form 2210 is used to calculate and pay the penalty for underpaying your estimated tax by individuals, estates, and trusts. Attach form 2210 and a statement to your return explaining the reasons you were unable to meet the estimated tax requirements and the time. Irs form 2210, underpayment of estimated tax by individuals, estates, and trusts, is a tax document.

IRS Form 2210Fill it with the Best Form Filler

Attach form 2210 and a statement to your return explaining the reasons you were unable to meet the estimated tax requirements and the time. Form 2210 is used to calculate and pay the penalty for underpaying your estimated tax by individuals, estates, and trusts. Irs form 2210, underpayment of estimated tax by individuals, estates, and trusts, is a tax document.

IRS Form 2210Fill it with the Best Form Filler

Irs form 2210, underpayment of estimated tax by individuals, estates, and trusts, is a tax document that some taxpayers are required to. Attach form 2210 and a statement to your return explaining the reasons you were unable to meet the estimated tax requirements and the time. Form 2210 is used to calculate and pay the penalty for underpaying your estimated.

Estimated vs Withholding Tax Penalty rules Saverocity Finance

Form 2210 is used to calculate and pay the penalty for underpaying your estimated tax by individuals, estates, and trusts. Attach form 2210 and a statement to your return explaining the reasons you were unable to meet the estimated tax requirements and the time. Irs form 2210, underpayment of estimated tax by individuals, estates, and trusts, is a tax document.

Attach Form 2210 And A Statement To Your Return Explaining The Reasons You Were Unable To Meet The Estimated Tax Requirements And The Time.

Irs form 2210, underpayment of estimated tax by individuals, estates, and trusts, is a tax document that some taxpayers are required to. Form 2210 is used to calculate and pay the penalty for underpaying your estimated tax by individuals, estates, and trusts.