What Is The Difference Between Arizona Form 5000 And 5000A

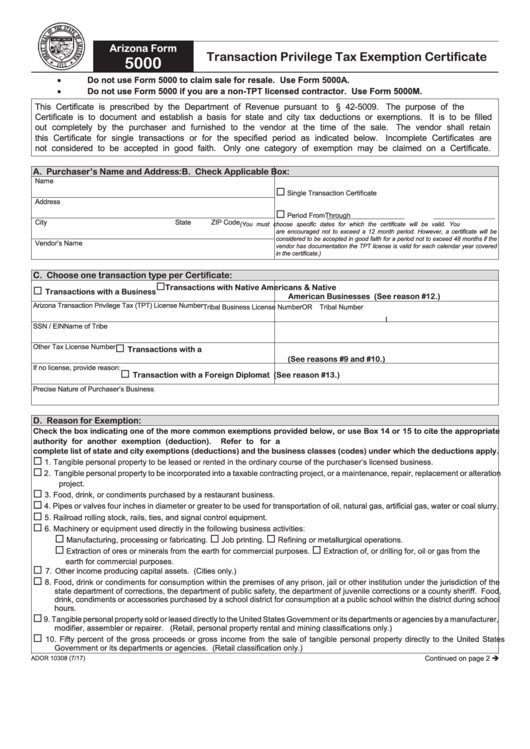

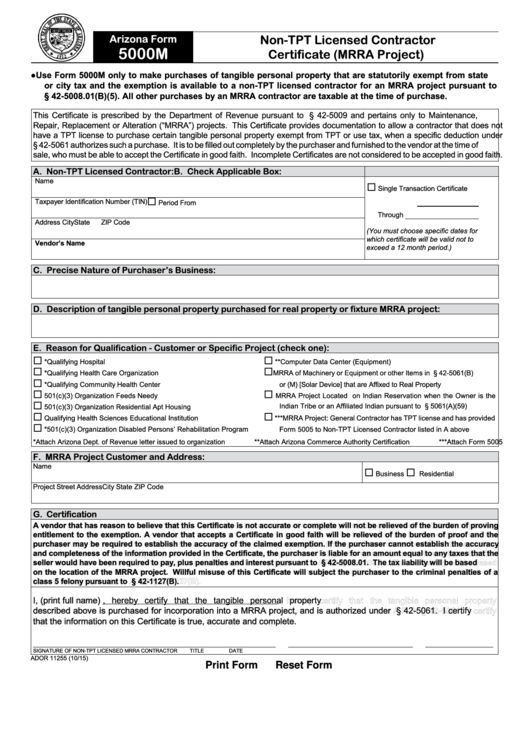

What Is The Difference Between Arizona Form 5000 And 5000A - • do not use form 5000 to claim sale for resale. What are the az state forms and what are they used for? The state of arizona has updated az form 5000 and az form 5000a, which are provided to vendors when claiming sales tax. This certificate is prescribed by the department of. For instance, the department specified that taxpayers should begin documenting sale for resale exemptions on arizona form 5000a. Arizona form 5000a is used to claim arizona tpt (sales tax) exemptions from a vendor when making purchases for resale. Some forms are provided by the prime. 8 rows the department has issued forms which correspond to specific contracting scenarios.

The state of arizona has updated az form 5000 and az form 5000a, which are provided to vendors when claiming sales tax. What are the az state forms and what are they used for? • do not use form 5000 to claim sale for resale. 8 rows the department has issued forms which correspond to specific contracting scenarios. Arizona form 5000a is used to claim arizona tpt (sales tax) exemptions from a vendor when making purchases for resale. For instance, the department specified that taxpayers should begin documenting sale for resale exemptions on arizona form 5000a. This certificate is prescribed by the department of. Some forms are provided by the prime.

• do not use form 5000 to claim sale for resale. 8 rows the department has issued forms which correspond to specific contracting scenarios. The state of arizona has updated az form 5000 and az form 5000a, which are provided to vendors when claiming sales tax. Some forms are provided by the prime. Arizona form 5000a is used to claim arizona tpt (sales tax) exemptions from a vendor when making purchases for resale. What are the az state forms and what are they used for? This certificate is prescribed by the department of. For instance, the department specified that taxpayers should begin documenting sale for resale exemptions on arizona form 5000a.

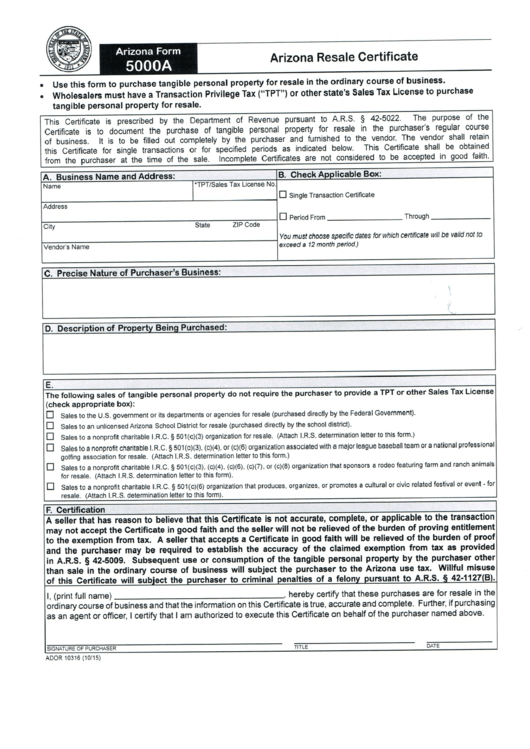

Arizona Form 5000a Arizona Resale Certificate printable pdf download

Arizona form 5000a is used to claim arizona tpt (sales tax) exemptions from a vendor when making purchases for resale. • do not use form 5000 to claim sale for resale. 8 rows the department has issued forms which correspond to specific contracting scenarios. The state of arizona has updated az form 5000 and az form 5000a, which are provided.

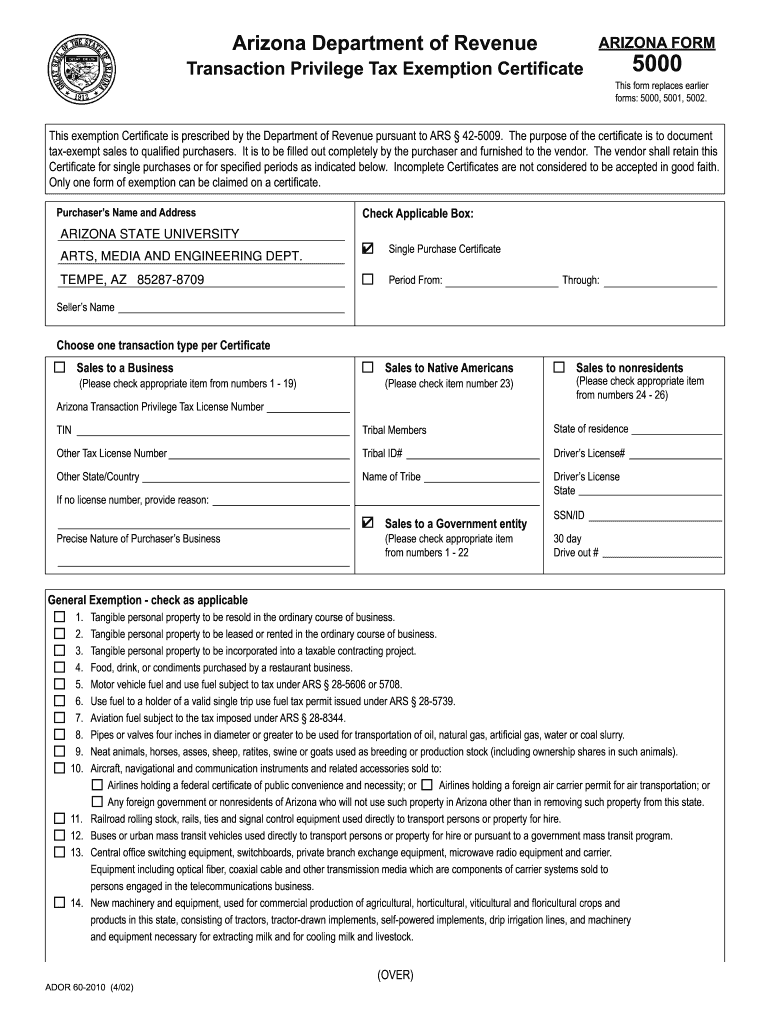

Arizona Form 5000 Fillable Printable Forms Free Online

The state of arizona has updated az form 5000 and az form 5000a, which are provided to vendors when claiming sales tax. This certificate is prescribed by the department of. 8 rows the department has issued forms which correspond to specific contracting scenarios. Arizona form 5000a is used to claim arizona tpt (sales tax) exemptions from a vendor when making.

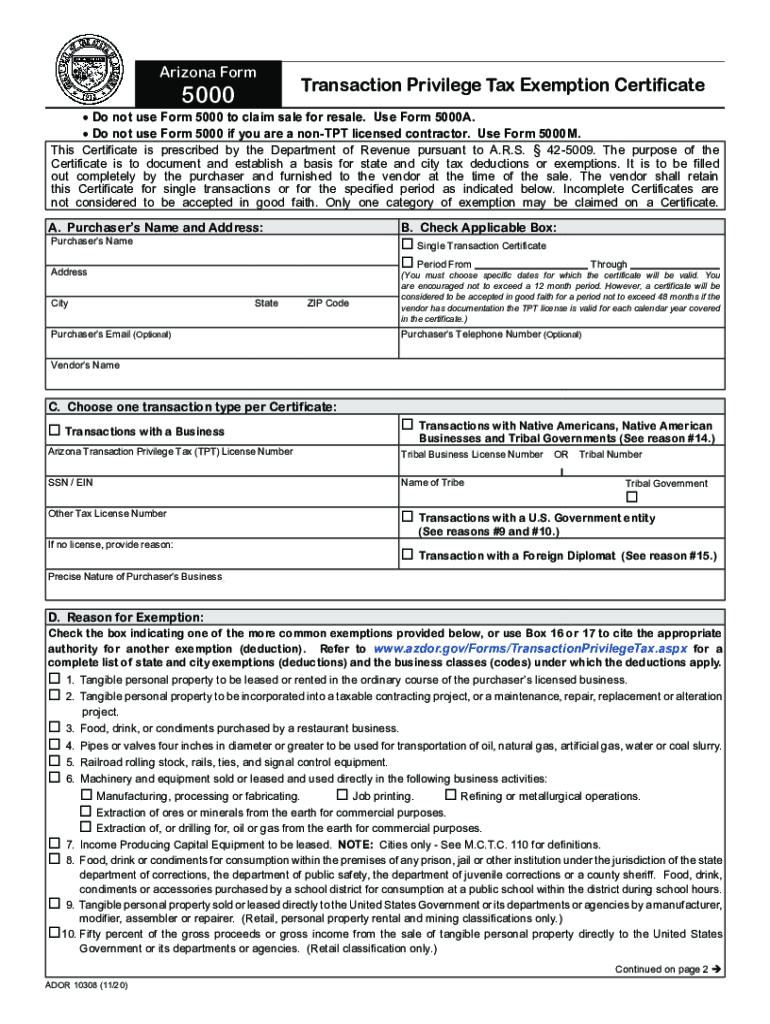

2020 Form AZ DoR 5000 Fill Online, Printable, Fillable, Blank pdfFiller

8 rows the department has issued forms which correspond to specific contracting scenarios. What are the az state forms and what are they used for? For instance, the department specified that taxpayers should begin documenting sale for resale exemptions on arizona form 5000a. Some forms are provided by the prime. This certificate is prescribed by the department of.

Arizona Form 5000 Transaction Privilege Tax Exemption Certificate

• do not use form 5000 to claim sale for resale. Some forms are provided by the prime. The state of arizona has updated az form 5000 and az form 5000a, which are provided to vendors when claiming sales tax. This certificate is prescribed by the department of. What are the az state forms and what are they used for?

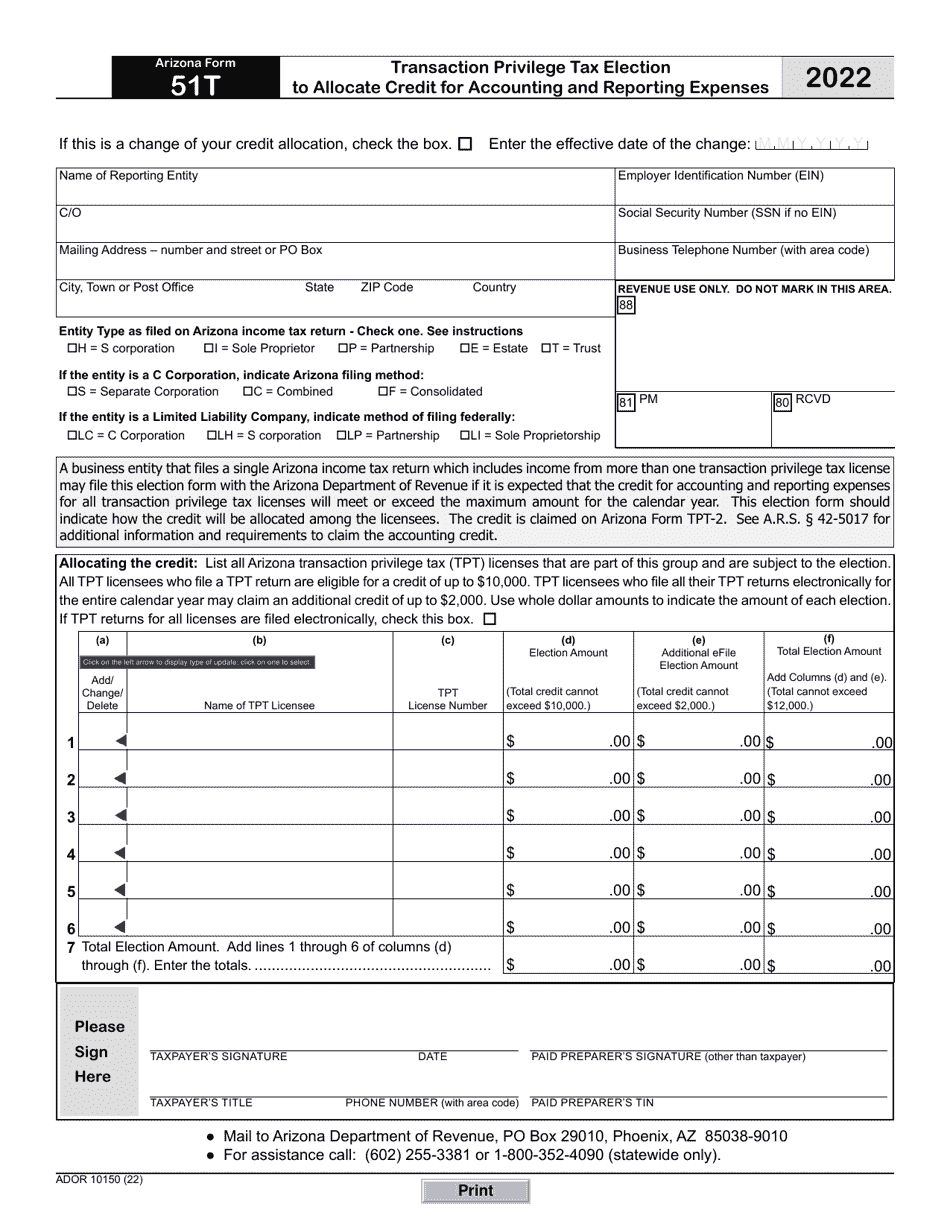

Arizona Form 51T (ADOR10150) Download Fillable PDF or Fill Online

Some forms are provided by the prime. • do not use form 5000 to claim sale for resale. Arizona form 5000a is used to claim arizona tpt (sales tax) exemptions from a vendor when making purchases for resale. For instance, the department specified that taxpayers should begin documenting sale for resale exemptions on arizona form 5000a. What are the az.

Form 5000a Fillable Printable Forms Free Online

• do not use form 5000 to claim sale for resale. What are the az state forms and what are they used for? For instance, the department specified that taxpayers should begin documenting sale for resale exemptions on arizona form 5000a. 8 rows the department has issued forms which correspond to specific contracting scenarios. This certificate is prescribed by the.

Downloads

Some forms are provided by the prime. • do not use form 5000 to claim sale for resale. What are the az state forms and what are they used for? For instance, the department specified that taxpayers should begin documenting sale for resale exemptions on arizona form 5000a. 8 rows the department has issued forms which correspond to specific contracting.

Arizona 5000 Form ≡ Fill Out Printable PDF Forms Online

For instance, the department specified that taxpayers should begin documenting sale for resale exemptions on arizona form 5000a. Some forms are provided by the prime. 8 rows the department has issued forms which correspond to specific contracting scenarios. • do not use form 5000 to claim sale for resale. What are the az state forms and what are they used.

Fillable Online Fillable Form 5000A Arizona Resale Certificate Fax

For instance, the department specified that taxpayers should begin documenting sale for resale exemptions on arizona form 5000a. This certificate is prescribed by the department of. Some forms are provided by the prime. The state of arizona has updated az form 5000 and az form 5000a, which are provided to vendors when claiming sales tax. Arizona form 5000a is used.

Arizona Form 5000 Instructions

This certificate is prescribed by the department of. 8 rows the department has issued forms which correspond to specific contracting scenarios. For instance, the department specified that taxpayers should begin documenting sale for resale exemptions on arizona form 5000a. What are the az state forms and what are they used for? Arizona form 5000a is used to claim arizona tpt.

Arizona Form 5000A Is Used To Claim Arizona Tpt (Sales Tax) Exemptions From A Vendor When Making Purchases For Resale.

Some forms are provided by the prime. The state of arizona has updated az form 5000 and az form 5000a, which are provided to vendors when claiming sales tax. What are the az state forms and what are they used for? • do not use form 5000 to claim sale for resale.

8 Rows The Department Has Issued Forms Which Correspond To Specific Contracting Scenarios.

For instance, the department specified that taxpayers should begin documenting sale for resale exemptions on arizona form 5000a. This certificate is prescribed by the department of.