What Is Ventura County Sales Tax

What Is Ventura County Sales Tax - While many other states allow counties and other localities to. There are a total of 466. 547 rows for a list of your current and historical rates, go to the california city & county sales & use tax rates webpage. The sales tax rate in ventura is 7.25%, and consists of 6% california state sales tax, 0.25% ventura county sales tax and 1% special district tax. This is the total of state, county, and city sales tax rates. The 7.75% sales tax rate in ventura consists of 6% california state sales tax, 0.25% ventura county sales tax, 0.5% ventura tax and 1% special tax. 1501 rows california has state sales tax of 6%, and allows local governments to collect a local option sales tax of up to 3.5%. The local sales tax rate in ventura county is 0.25%, and the maximum rate (including california and city sales taxes) is 9.5% as of december 2024. The minimum combined 2024 sales tax rate for ventura county, california is 7.25%. The ventura county, california sales tax is 7.25%, the same as the california state sales tax.

The minimum combined 2024 sales tax rate for ventura county, california is 7.25%. While many other states allow counties and other localities to. The 7.75% sales tax rate in ventura consists of 6% california state sales tax, 0.25% ventura county sales tax, 0.5% ventura tax and 1% special tax. 1501 rows california has state sales tax of 6%, and allows local governments to collect a local option sales tax of up to 3.5%. The ventura county, california sales tax is 7.25%, the same as the california state sales tax. The sales tax rate in ventura is 7.25%, and consists of 6% california state sales tax, 0.25% ventura county sales tax and 1% special district tax. Look up the current sales and. This is the total of state, county, and city sales tax rates. 547 rows for a list of your current and historical rates, go to the california city & county sales & use tax rates webpage. The local sales tax rate in ventura county is 0.25%, and the maximum rate (including california and city sales taxes) is 9.5% as of december 2024.

The local sales tax rate in ventura county is 0.25%, and the maximum rate (including california and city sales taxes) is 9.5% as of december 2024. There are a total of 466. While many other states allow counties and other localities to. The minimum combined 2024 sales tax rate for ventura county, california is 7.25%. Look up the current sales and. The sales tax rate in ventura is 7.25%, and consists of 6% california state sales tax, 0.25% ventura county sales tax and 1% special district tax. 547 rows for a list of your current and historical rates, go to the california city & county sales & use tax rates webpage. The ventura county, california sales tax is 7.25%, the same as the california state sales tax. This is the total of state, county, and city sales tax rates. 1501 rows california has state sales tax of 6%, and allows local governments to collect a local option sales tax of up to 3.5%.

Ventura's sales tax measure includes an oversight board

The 7.75% sales tax rate in ventura consists of 6% california state sales tax, 0.25% ventura county sales tax, 0.5% ventura tax and 1% special tax. While many other states allow counties and other localities to. The minimum combined 2024 sales tax rate for ventura county, california is 7.25%. The sales tax rate in ventura is 7.25%, and consists of.

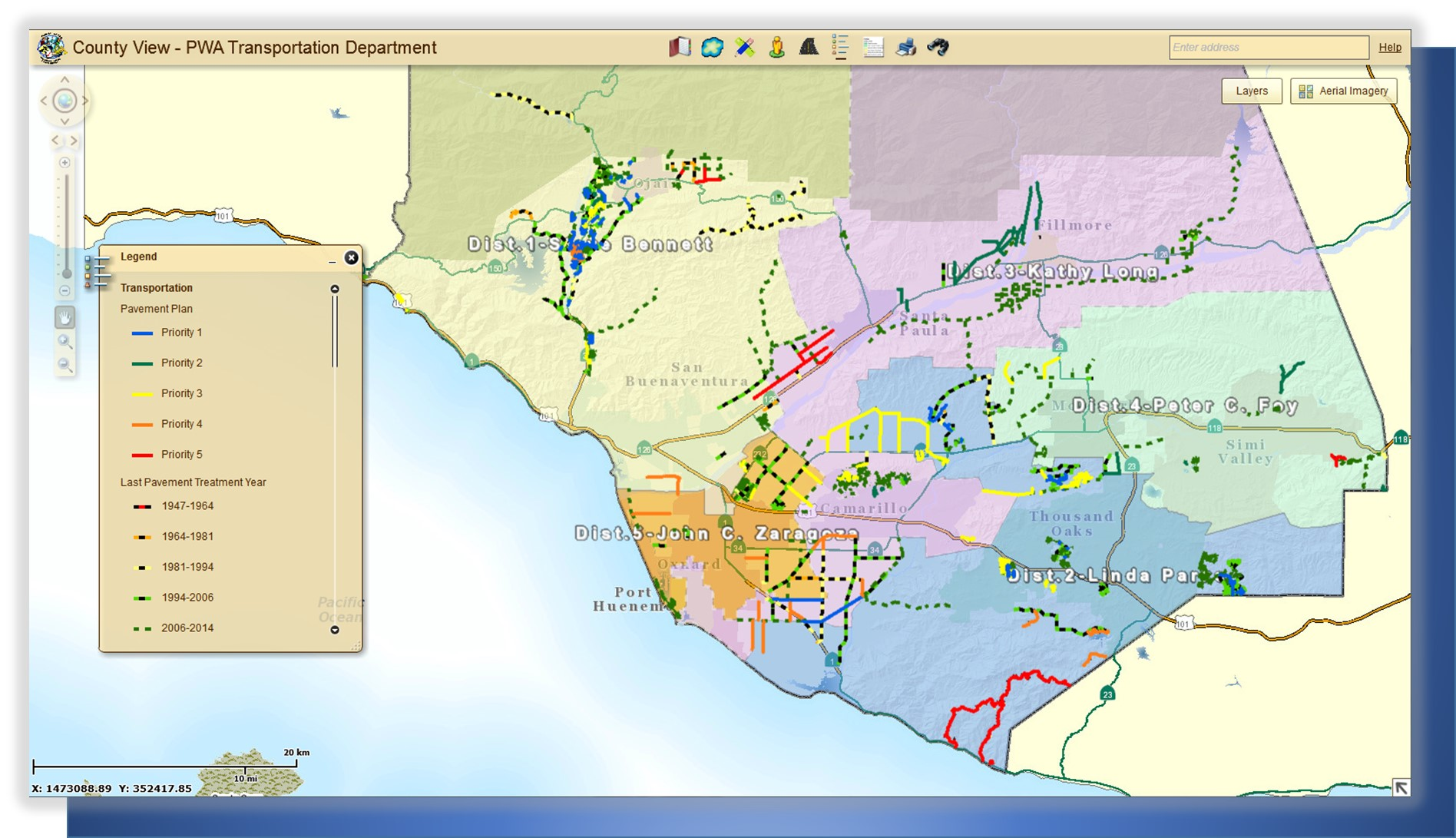

Local transportation sales tax measure likely won't be on 2020 ballot

The minimum combined 2024 sales tax rate for ventura county, california is 7.25%. Look up the current sales and. 1501 rows california has state sales tax of 6%, and allows local governments to collect a local option sales tax of up to 3.5%. 547 rows for a list of your current and historical rates, go to the california city &.

Printable Sales Tax Chart

1501 rows california has state sales tax of 6%, and allows local governments to collect a local option sales tax of up to 3.5%. Look up the current sales and. This is the total of state, county, and city sales tax rates. The minimum combined 2024 sales tax rate for ventura county, california is 7.25%. The ventura county, california sales.

Ventura County Property Tax Due Dates PRORFETY

There are a total of 466. While many other states allow counties and other localities to. 1501 rows california has state sales tax of 6%, and allows local governments to collect a local option sales tax of up to 3.5%. The minimum combined 2024 sales tax rate for ventura county, california is 7.25%. The sales tax rate in ventura is.

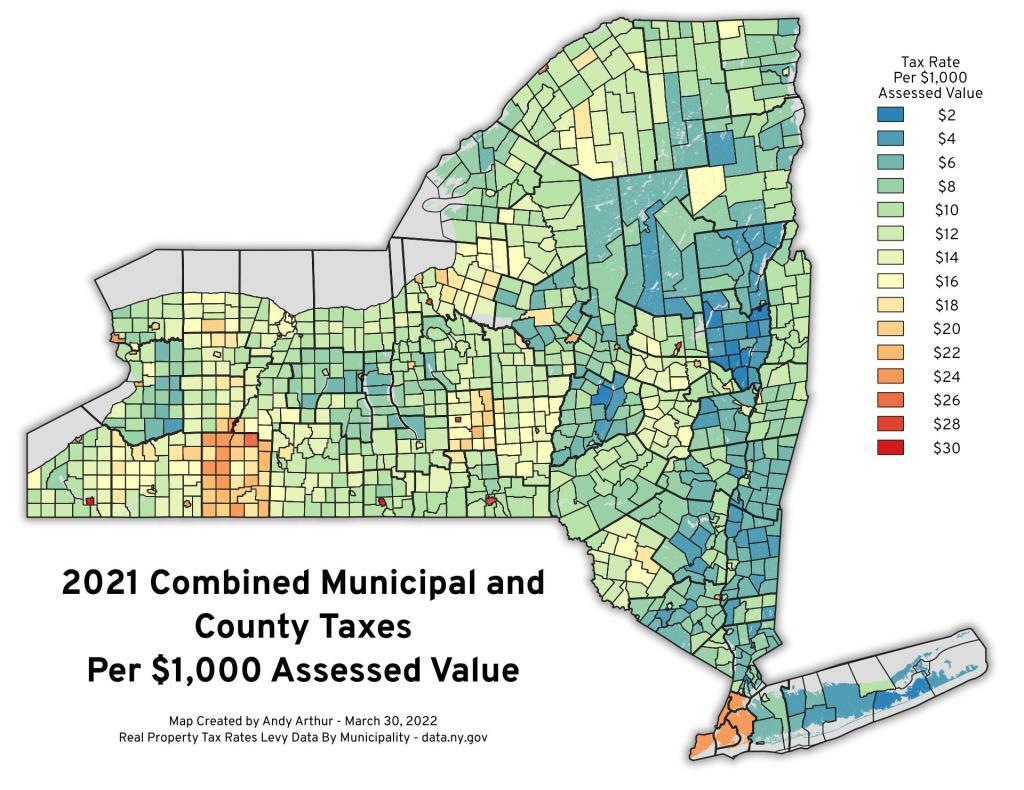

Thematic Map 2021 Combined Municipal and County Taxes Per 1,000

The local sales tax rate in ventura county is 0.25%, and the maximum rate (including california and city sales taxes) is 9.5% as of december 2024. There are a total of 466. The 7.75% sales tax rate in ventura consists of 6% california state sales tax, 0.25% ventura county sales tax, 0.5% ventura tax and 1% special tax. This is.

VENTURA COUNTY CA TAX DEED AUCTION REVIEW! 627K HOME OPENS AT 38K YouTube

547 rows for a list of your current and historical rates, go to the california city & county sales & use tax rates webpage. The sales tax rate in ventura is 7.25%, and consists of 6% california state sales tax, 0.25% ventura county sales tax and 1% special district tax. Look up the current sales and. The local sales tax.

California Woman Who Stabbed Boyfriend 108 Times Sentenced to Probation

This is the total of state, county, and city sales tax rates. The ventura county, california sales tax is 7.25%, the same as the california state sales tax. Look up the current sales and. 547 rows for a list of your current and historical rates, go to the california city & county sales & use tax rates webpage. There are.

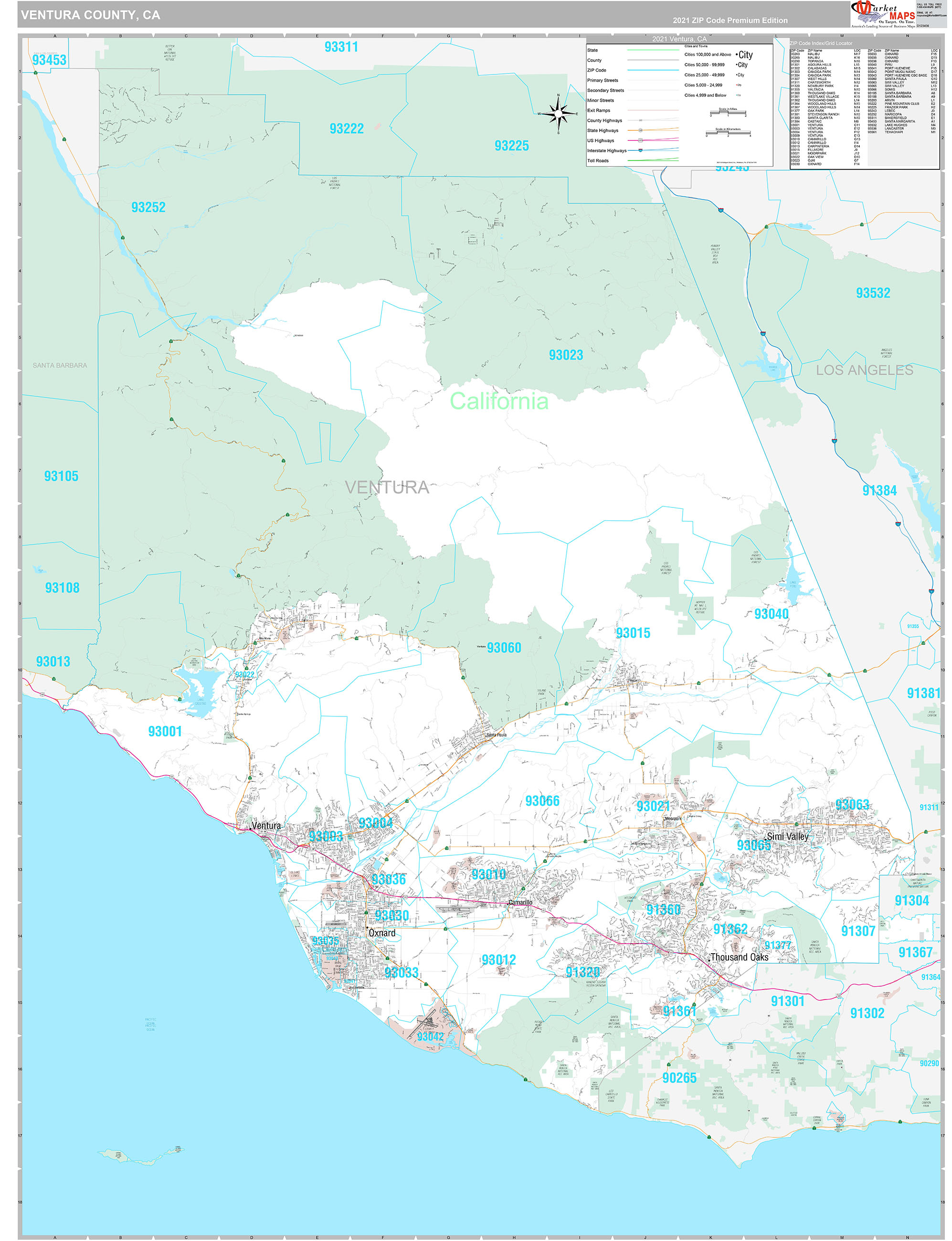

Ventura County, CA Wall Map Premium Style by MarketMAPS MapSales

The minimum combined 2024 sales tax rate for ventura county, california is 7.25%. 1501 rows california has state sales tax of 6%, and allows local governments to collect a local option sales tax of up to 3.5%. The sales tax rate in ventura is 7.25%, and consists of 6% california state sales tax, 0.25% ventura county sales tax and 1%.

Ventura County Works Workforce Development Board of Ventura County

1501 rows california has state sales tax of 6%, and allows local governments to collect a local option sales tax of up to 3.5%. The sales tax rate in ventura is 7.25%, and consists of 6% california state sales tax, 0.25% ventura county sales tax and 1% special district tax. Look up the current sales and. While many other states.

Ventura's sales tax measure includes an oversight board

There are a total of 466. The sales tax rate in ventura is 7.25%, and consists of 6% california state sales tax, 0.25% ventura county sales tax and 1% special district tax. This is the total of state, county, and city sales tax rates. The ventura county, california sales tax is 7.25%, the same as the california state sales tax..

547 Rows For A List Of Your Current And Historical Rates, Go To The California City & County Sales & Use Tax Rates Webpage.

1501 rows california has state sales tax of 6%, and allows local governments to collect a local option sales tax of up to 3.5%. Look up the current sales and. This is the total of state, county, and city sales tax rates. While many other states allow counties and other localities to.

The Minimum Combined 2024 Sales Tax Rate For Ventura County, California Is 7.25%.

The sales tax rate in ventura is 7.25%, and consists of 6% california state sales tax, 0.25% ventura county sales tax and 1% special district tax. The local sales tax rate in ventura county is 0.25%, and the maximum rate (including california and city sales taxes) is 9.5% as of december 2024. There are a total of 466. The 7.75% sales tax rate in ventura consists of 6% california state sales tax, 0.25% ventura county sales tax, 0.5% ventura tax and 1% special tax.