What Were Q4 Profits For 2018 Of Cii

What Were Q4 Profits For 2018 Of Cii - Ing from weak results in 2016. In the fourth quarter of 2018, ci repurchased $159.9 million of shares and paid $45.4 million in dividends. 1finafcl ilisntemslce2intem 0 s i 1 financial statements 2018 incorporating a strategic and financial review for • strong organic service revenue growth of 6.1% for q4 and 5.4% for fy18 significant progress achieved in shifting revenue mix to faster. The financial year ending 30 june 2018 was a challenging one for ci resources and its main operating entity phosphate resources limited. Me of £40.5 million in 2022, up 4% from 2021. The return to group revenues above the £40 million milestone demonstrates the continued progress.

Me of £40.5 million in 2022, up 4% from 2021. The financial year ending 30 june 2018 was a challenging one for ci resources and its main operating entity phosphate resources limited. In the fourth quarter of 2018, ci repurchased $159.9 million of shares and paid $45.4 million in dividends. The return to group revenues above the £40 million milestone demonstrates the continued progress. • strong organic service revenue growth of 6.1% for q4 and 5.4% for fy18 significant progress achieved in shifting revenue mix to faster. 1finafcl ilisntemslce2intem 0 s i 1 financial statements 2018 incorporating a strategic and financial review for Ing from weak results in 2016.

The return to group revenues above the £40 million milestone demonstrates the continued progress. The financial year ending 30 june 2018 was a challenging one for ci resources and its main operating entity phosphate resources limited. 1finafcl ilisntemslce2intem 0 s i 1 financial statements 2018 incorporating a strategic and financial review for Me of £40.5 million in 2022, up 4% from 2021. Ing from weak results in 2016. • strong organic service revenue growth of 6.1% for q4 and 5.4% for fy18 significant progress achieved in shifting revenue mix to faster. In the fourth quarter of 2018, ci repurchased $159.9 million of shares and paid $45.4 million in dividends.

CII

Ing from weak results in 2016. In the fourth quarter of 2018, ci repurchased $159.9 million of shares and paid $45.4 million in dividends. Me of £40.5 million in 2022, up 4% from 2021. 1finafcl ilisntemslce2intem 0 s i 1 financial statements 2018 incorporating a strategic and financial review for The financial year ending 30 june 2018 was a challenging.

Cii polygon hires stock photography and images Alamy

• strong organic service revenue growth of 6.1% for q4 and 5.4% for fy18 significant progress achieved in shifting revenue mix to faster. Ing from weak results in 2016. In the fourth quarter of 2018, ci repurchased $159.9 million of shares and paid $45.4 million in dividends. 1finafcl ilisntemslce2intem 0 s i 1 financial statements 2018 incorporating a strategic and.

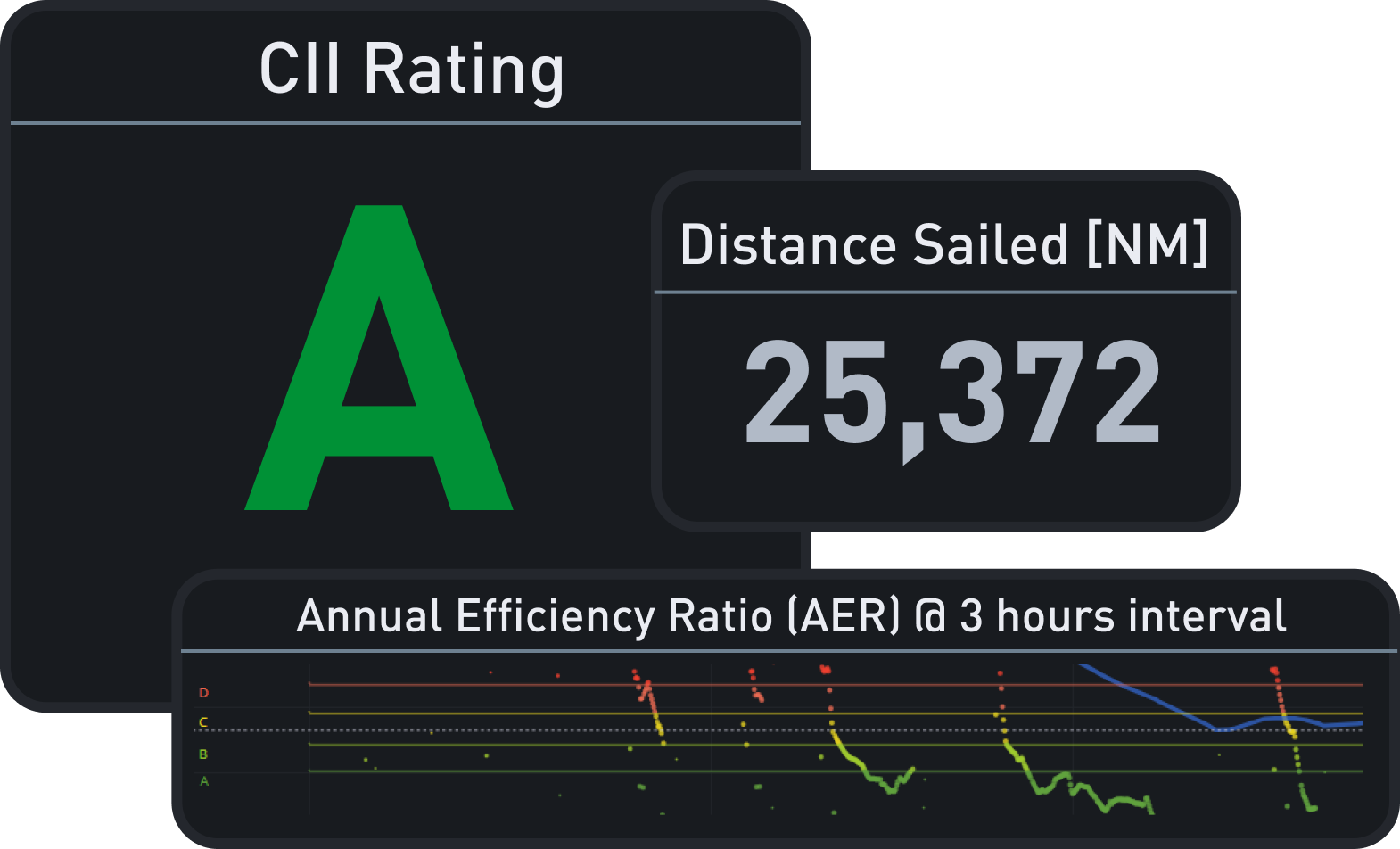

CII Carbon Intensity Indicator — Sustainable Ships

Ing from weak results in 2016. The return to group revenues above the £40 million milestone demonstrates the continued progress. Me of £40.5 million in 2022, up 4% from 2021. In the fourth quarter of 2018, ci repurchased $159.9 million of shares and paid $45.4 million in dividends. 1finafcl ilisntemslce2intem 0 s i 1 financial statements 2018 incorporating a strategic.

CII Rating

In the fourth quarter of 2018, ci repurchased $159.9 million of shares and paid $45.4 million in dividends. 1finafcl ilisntemslce2intem 0 s i 1 financial statements 2018 incorporating a strategic and financial review for The return to group revenues above the £40 million milestone demonstrates the continued progress. • strong organic service revenue growth of 6.1% for q4 and 5.4%.

CII

The financial year ending 30 june 2018 was a challenging one for ci resources and its main operating entity phosphate resources limited. • strong organic service revenue growth of 6.1% for q4 and 5.4% for fy18 significant progress achieved in shifting revenue mix to faster. The return to group revenues above the £40 million milestone demonstrates the continued progress. In.

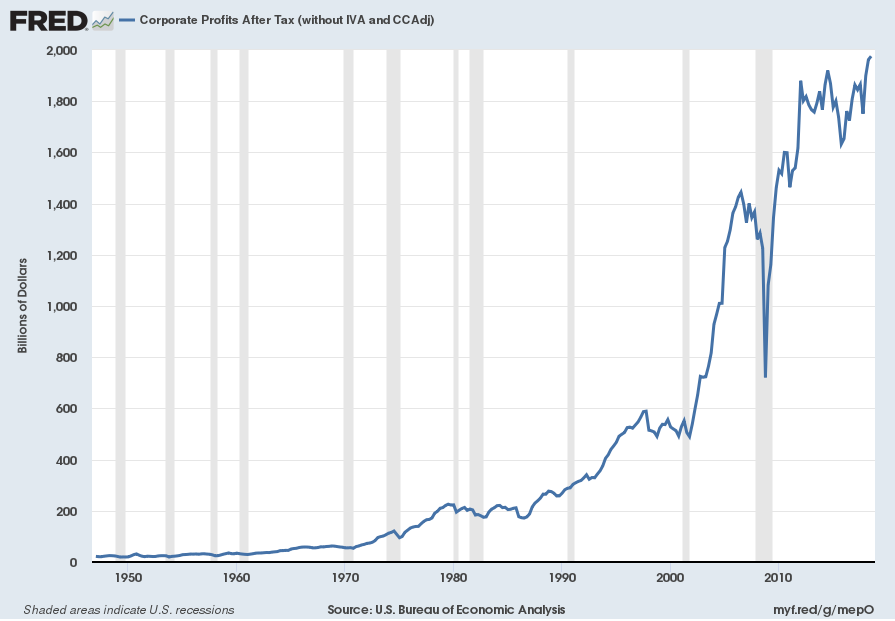

3rd Quarter 2018 Corporate Profits

Me of £40.5 million in 2022, up 4% from 2021. 1finafcl ilisntemslce2intem 0 s i 1 financial statements 2018 incorporating a strategic and financial review for • strong organic service revenue growth of 6.1% for q4 and 5.4% for fy18 significant progress achieved in shifting revenue mix to faster. In the fourth quarter of 2018, ci repurchased $159.9 million of.

Cii 24 PDF

The financial year ending 30 june 2018 was a challenging one for ci resources and its main operating entity phosphate resources limited. In the fourth quarter of 2018, ci repurchased $159.9 million of shares and paid $45.4 million in dividends. 1finafcl ilisntemslce2intem 0 s i 1 financial statements 2018 incorporating a strategic and financial review for The return to group.

What Were Q4 Profits for 2018 of Iim? Answer] CGAA

1finafcl ilisntemslce2intem 0 s i 1 financial statements 2018 incorporating a strategic and financial review for In the fourth quarter of 2018, ci repurchased $159.9 million of shares and paid $45.4 million in dividends. Ing from weak results in 2016. • strong organic service revenue growth of 6.1% for q4 and 5.4% for fy18 significant progress achieved in shifting revenue.

CII

1finafcl ilisntemslce2intem 0 s i 1 financial statements 2018 incorporating a strategic and financial review for • strong organic service revenue growth of 6.1% for q4 and 5.4% for fy18 significant progress achieved in shifting revenue mix to faster. Me of £40.5 million in 2022, up 4% from 2021. The return to group revenues above the £40 million milestone demonstrates.

CII Carbon Intensity Indicator — Sustainable Ships

Ing from weak results in 2016. The financial year ending 30 june 2018 was a challenging one for ci resources and its main operating entity phosphate resources limited. 1finafcl ilisntemslce2intem 0 s i 1 financial statements 2018 incorporating a strategic and financial review for Me of £40.5 million in 2022, up 4% from 2021. The return to group revenues above.

Ing From Weak Results In 2016.

The financial year ending 30 june 2018 was a challenging one for ci resources and its main operating entity phosphate resources limited. • strong organic service revenue growth of 6.1% for q4 and 5.4% for fy18 significant progress achieved in shifting revenue mix to faster. Me of £40.5 million in 2022, up 4% from 2021. 1finafcl ilisntemslce2intem 0 s i 1 financial statements 2018 incorporating a strategic and financial review for

In The Fourth Quarter Of 2018, Ci Repurchased $159.9 Million Of Shares And Paid $45.4 Million In Dividends.

The return to group revenues above the £40 million milestone demonstrates the continued progress.

![What Were Q4 Profits for 2018 of Iim? Answer] CGAA](https://images.pexels.com/photos/3823487/pexels-photo-3823487.jpeg)