Where Does Form 2439 Go On Tax Return

Where Does Form 2439 Go On Tax Return - What is this, and how do i report the info on my desktop turbo tax return? To enter form 2439 go to investment income and select undistributed capital gains or you can search for form 2439 in the top right. Income tax return for the tax year that includes the last day of the ric’s or reit’s tax year. Fees for other optional products or product features may apply.

Fees for other optional products or product features may apply. What is this, and how do i report the info on my desktop turbo tax return? To enter form 2439 go to investment income and select undistributed capital gains or you can search for form 2439 in the top right. Income tax return for the tax year that includes the last day of the ric’s or reit’s tax year.

What is this, and how do i report the info on my desktop turbo tax return? Income tax return for the tax year that includes the last day of the ric’s or reit’s tax year. Fees for other optional products or product features may apply. To enter form 2439 go to investment income and select undistributed capital gains or you can search for form 2439 in the top right.

The 2439 Form Explained

To enter form 2439 go to investment income and select undistributed capital gains or you can search for form 2439 in the top right. Income tax return for the tax year that includes the last day of the ric’s or reit’s tax year. Fees for other optional products or product features may apply. What is this, and how do i.

Instructions For 2024 Estimated Tax Worksheet Biddy Rosette

Fees for other optional products or product features may apply. What is this, and how do i report the info on my desktop turbo tax return? Income tax return for the tax year that includes the last day of the ric’s or reit’s tax year. To enter form 2439 go to investment income and select undistributed capital gains or you.

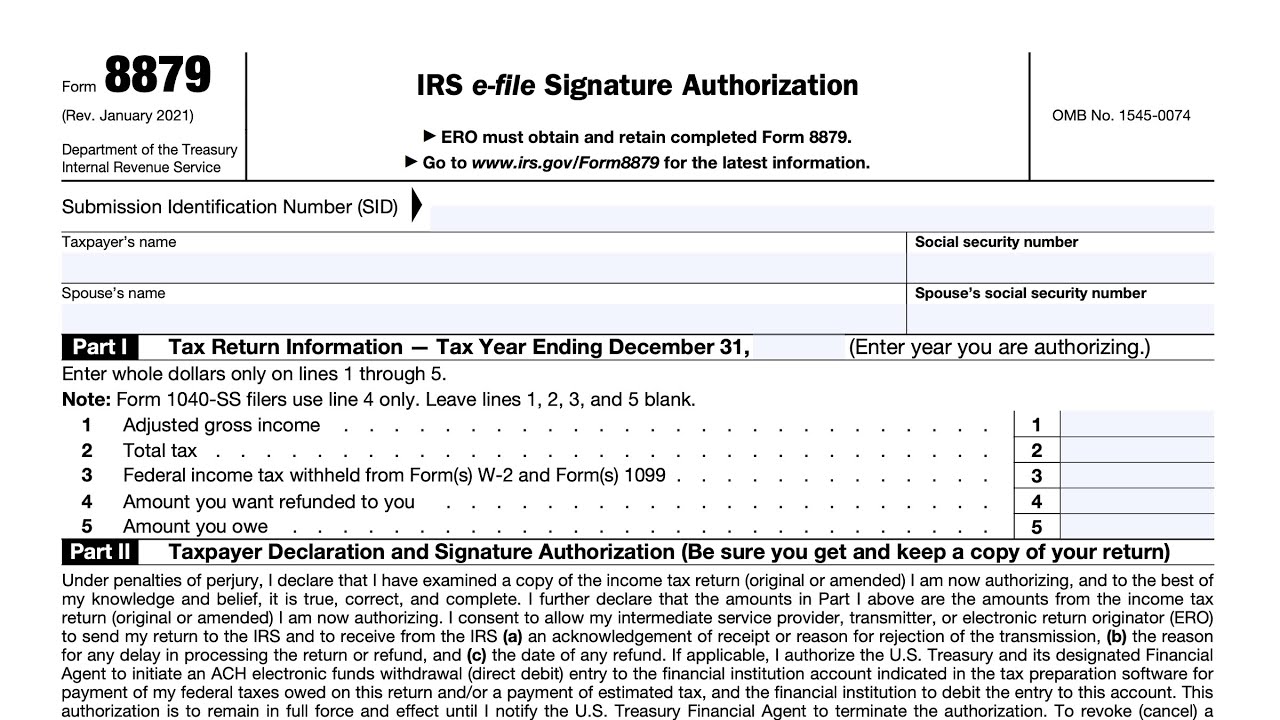

Printable Federal Tax Return Form Printable Forms Free Online

Fees for other optional products or product features may apply. Income tax return for the tax year that includes the last day of the ric’s or reit’s tax year. What is this, and how do i report the info on my desktop turbo tax return? To enter form 2439 go to investment income and select undistributed capital gains or you.

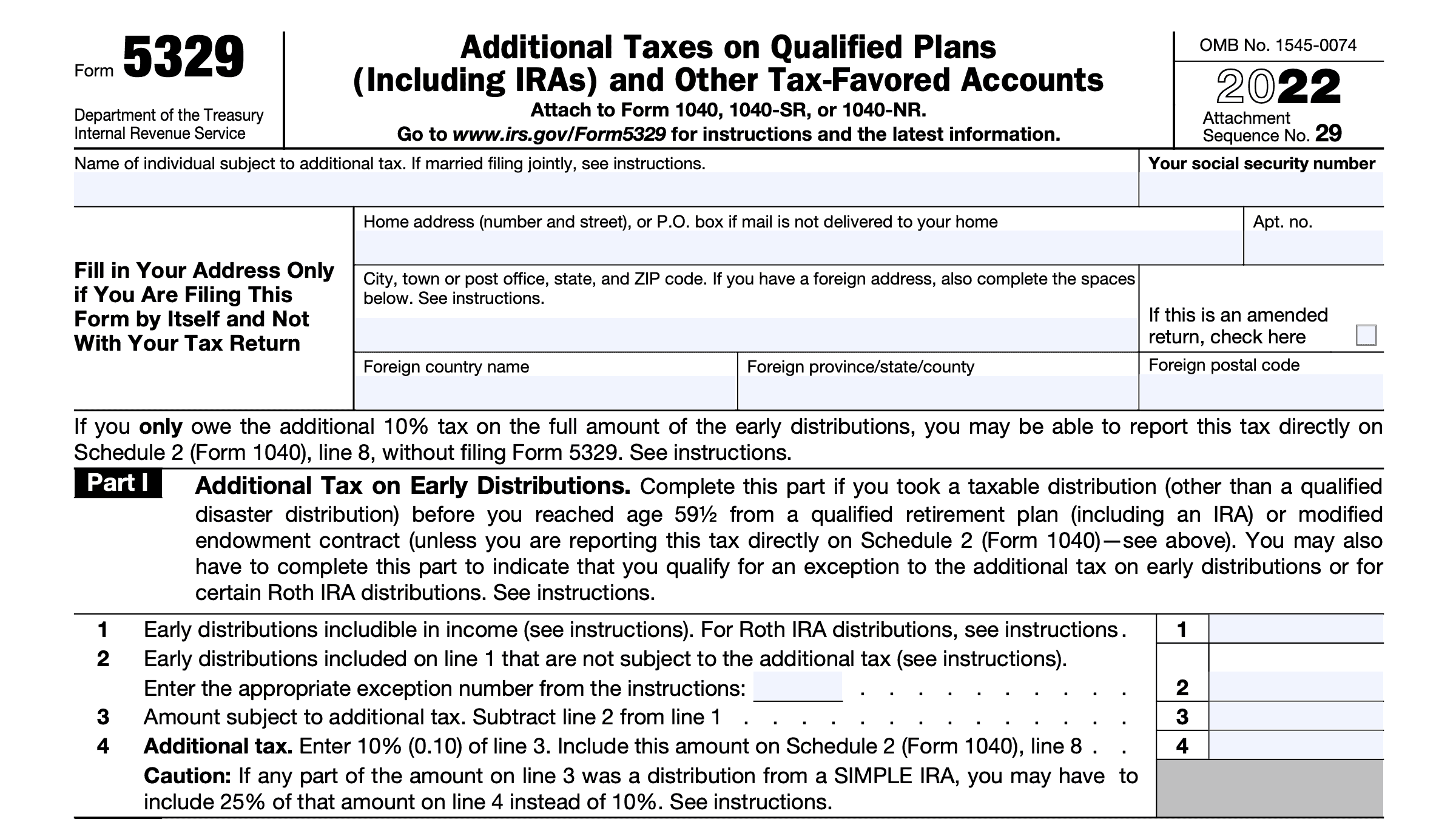

IRS Form 2439 Instructions Undistributed LongTerm Capital Gains

To enter form 2439 go to investment income and select undistributed capital gains or you can search for form 2439 in the top right. What is this, and how do i report the info on my desktop turbo tax return? Income tax return for the tax year that includes the last day of the ric’s or reit’s tax year. Fees.

Irs E File Tax Return

Fees for other optional products or product features may apply. What is this, and how do i report the info on my desktop turbo tax return? To enter form 2439 go to investment income and select undistributed capital gains or you can search for form 2439 in the top right. Income tax return for the tax year that includes the.

Irs 2024 Instructions 2024 Pdf Laney Mirella

Income tax return for the tax year that includes the last day of the ric’s or reit’s tax year. To enter form 2439 go to investment income and select undistributed capital gains or you can search for form 2439 in the top right. Fees for other optional products or product features may apply. What is this, and how do i.

Form 2439 Finance Reference

To enter form 2439 go to investment income and select undistributed capital gains or you can search for form 2439 in the top right. Fees for other optional products or product features may apply. Income tax return for the tax year that includes the last day of the ric’s or reit’s tax year. What is this, and how do i.

Brief Details on Understanding the 2439 tax form

Fees for other optional products or product features may apply. Income tax return for the tax year that includes the last day of the ric’s or reit’s tax year. To enter form 2439 go to investment income and select undistributed capital gains or you can search for form 2439 in the top right. What is this, and how do i.

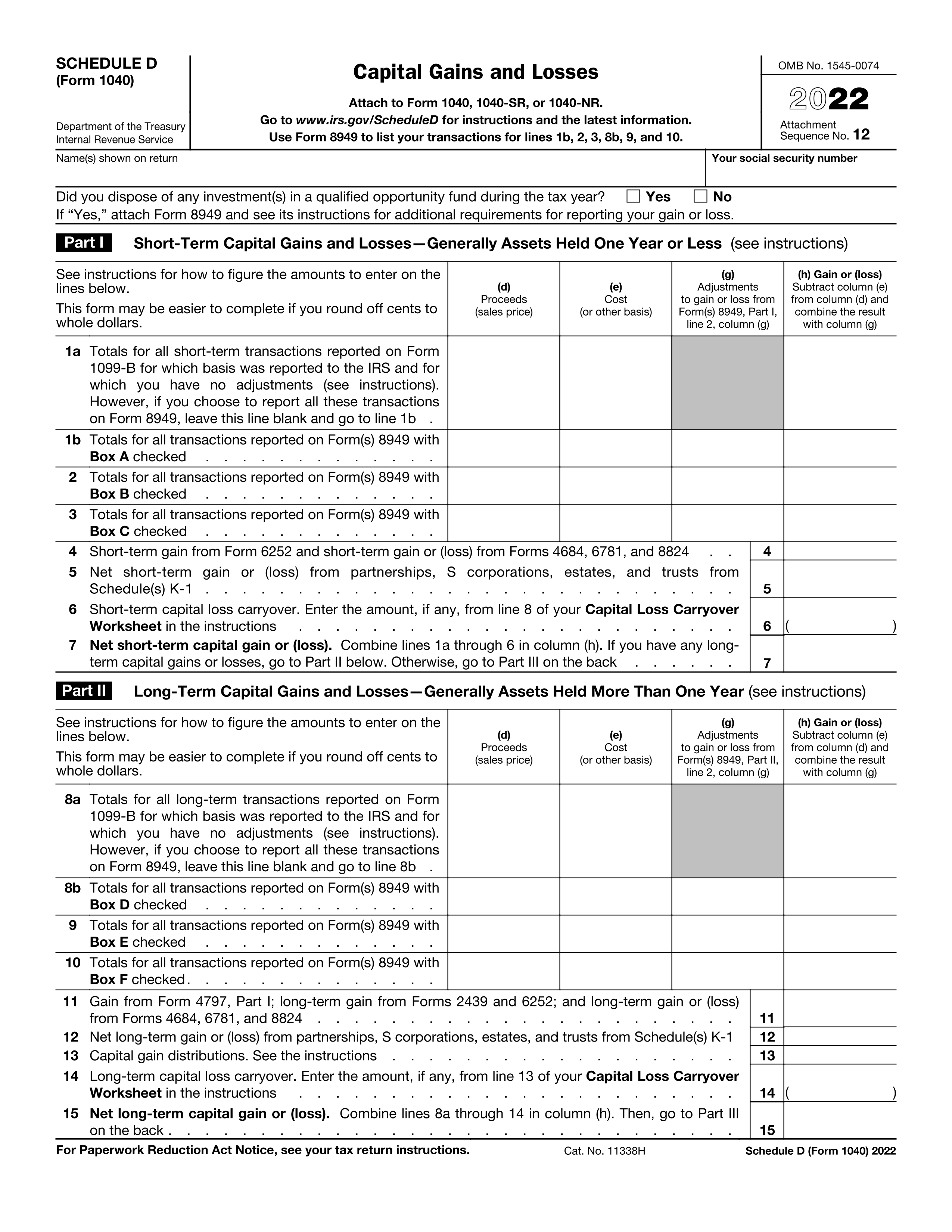

IRS Schedule D

What is this, and how do i report the info on my desktop turbo tax return? Fees for other optional products or product features may apply. Income tax return for the tax year that includes the last day of the ric’s or reit’s tax year. To enter form 2439 go to investment income and select undistributed capital gains or you.

What is Form 2439? Explained Reporting Undistributed LongTerm Capital

Income tax return for the tax year that includes the last day of the ric’s or reit’s tax year. What is this, and how do i report the info on my desktop turbo tax return? To enter form 2439 go to investment income and select undistributed capital gains or you can search for form 2439 in the top right. Fees.

Fees For Other Optional Products Or Product Features May Apply.

What is this, and how do i report the info on my desktop turbo tax return? To enter form 2439 go to investment income and select undistributed capital gains or you can search for form 2439 in the top right. Income tax return for the tax year that includes the last day of the ric’s or reit’s tax year.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at9.17.55AM-43bd78fa82bb4fa397892e3e69047cf2.png)