Cointracker Form 8949

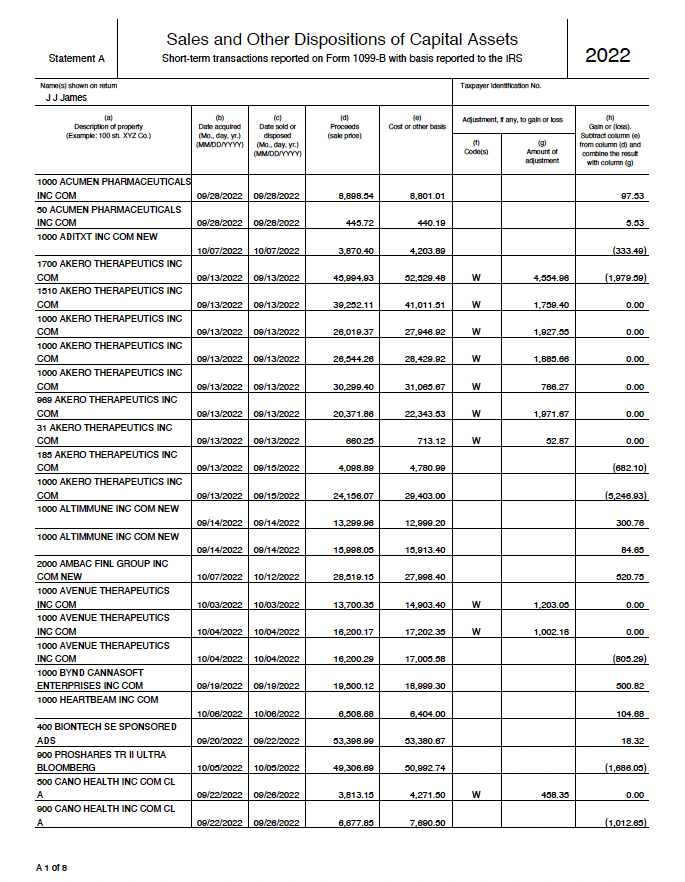

Cointracker Form 8949 - The irs uses information reported. This guide covers the various ways you can file your crypto taxes after purchasing a cointracker plan. Form 8949, schedule d, schedule 1, schedule a, schedule b, schedule c, schedule e and form 8275 are the most commonly used irs crypto. Form 8949 is used to report your cryptocurrency capital gains and losses. Form 8949 sales of capital assets: Cointracker, on the other hand, generates a irs form 8949 report which focuses on calculating your capital gains.

Cointracker, on the other hand, generates a irs form 8949 report which focuses on calculating your capital gains. The irs uses information reported. Form 8949, schedule d, schedule 1, schedule a, schedule b, schedule c, schedule e and form 8275 are the most commonly used irs crypto. Form 8949 sales of capital assets: This guide covers the various ways you can file your crypto taxes after purchasing a cointracker plan. Form 8949 is used to report your cryptocurrency capital gains and losses.

Form 8949, schedule d, schedule 1, schedule a, schedule b, schedule c, schedule e and form 8275 are the most commonly used irs crypto. Form 8949 sales of capital assets: Cointracker, on the other hand, generates a irs form 8949 report which focuses on calculating your capital gains. Form 8949 is used to report your cryptocurrency capital gains and losses. The irs uses information reported. This guide covers the various ways you can file your crypto taxes after purchasing a cointracker plan.

What Crypto Tax Forms Should I File?

Cointracker, on the other hand, generates a irs form 8949 report which focuses on calculating your capital gains. The irs uses information reported. Form 8949 is used to report your cryptocurrency capital gains and losses. This guide covers the various ways you can file your crypto taxes after purchasing a cointracker plan. Form 8949 sales of capital assets:

Three Tax Forms Crypto Users Must File With the IRS

Cointracker, on the other hand, generates a irs form 8949 report which focuses on calculating your capital gains. Form 8949 sales of capital assets: Form 8949 is used to report your cryptocurrency capital gains and losses. This guide covers the various ways you can file your crypto taxes after purchasing a cointracker plan. Form 8949, schedule d, schedule 1, schedule.

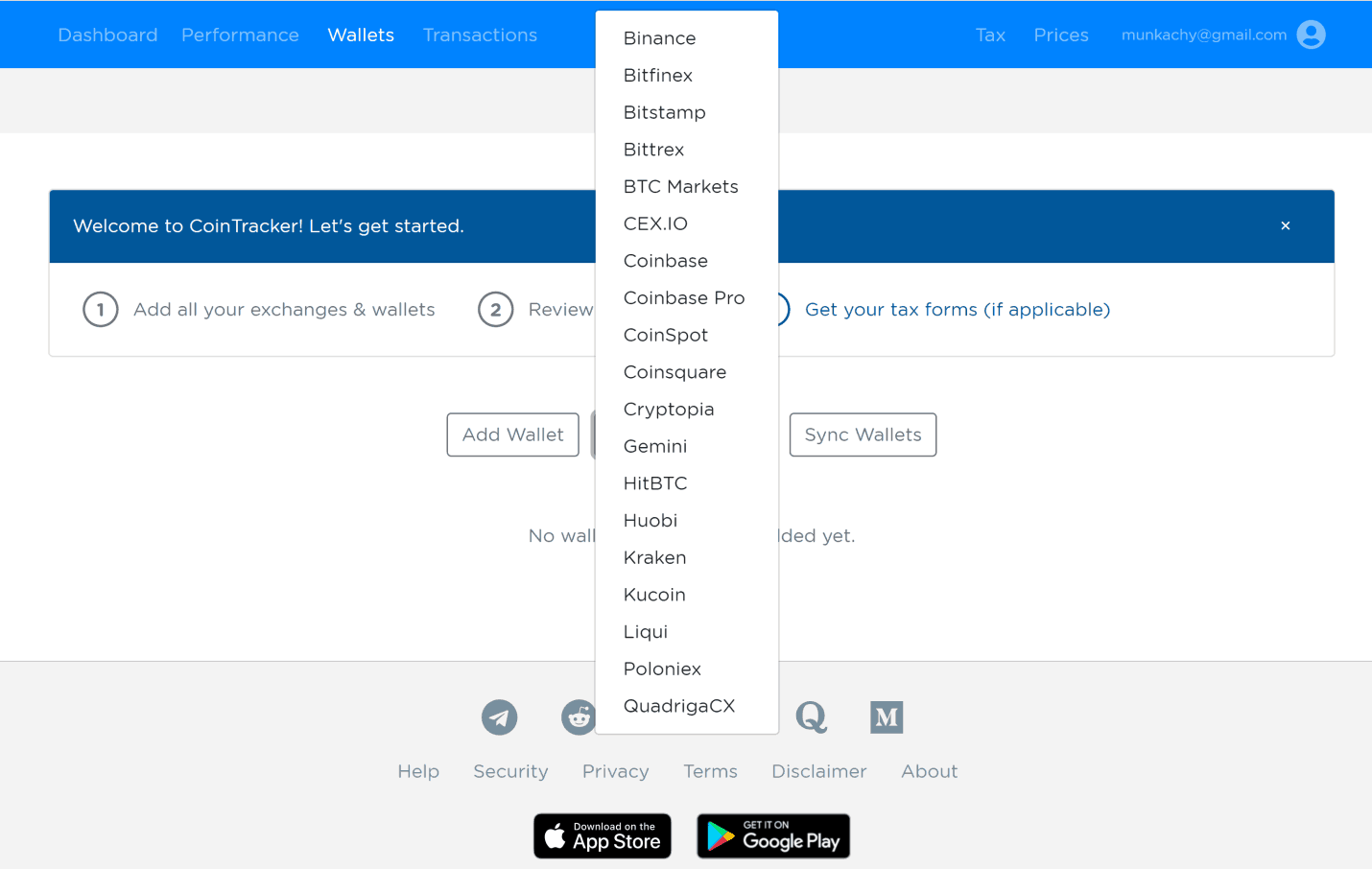

Using TurboTax or CoinTracker to report on cryptocurrency Coinbase Help

The irs uses information reported. Form 8949, schedule d, schedule 1, schedule a, schedule b, schedule c, schedule e and form 8275 are the most commonly used irs crypto. Form 8949 is used to report your cryptocurrency capital gains and losses. Cointracker, on the other hand, generates a irs form 8949 report which focuses on calculating your capital gains. Form.

Unable to generate 8949 tax form but able to generate other tax forms

This guide covers the various ways you can file your crypto taxes after purchasing a cointracker plan. Form 8949, schedule d, schedule 1, schedule a, schedule b, schedule c, schedule e and form 8275 are the most commonly used irs crypto. The irs uses information reported. Form 8949 is used to report your cryptocurrency capital gains and losses. Form 8949.

2022 IRS Form 8949 Not Received Bugs CoinTracker

This guide covers the various ways you can file your crypto taxes after purchasing a cointracker plan. Cointracker, on the other hand, generates a irs form 8949 report which focuses on calculating your capital gains. Form 8949, schedule d, schedule 1, schedule a, schedule b, schedule c, schedule e and form 8275 are the most commonly used irs crypto. Form.

Tax Center and form IRS 8949 have different values for capital gains

Cointracker, on the other hand, generates a irs form 8949 report which focuses on calculating your capital gains. Form 8949 sales of capital assets: Form 8949 is used to report your cryptocurrency capital gains and losses. The irs uses information reported. This guide covers the various ways you can file your crypto taxes after purchasing a cointracker plan.

CoinTracker And H&R Block Integration H&R Block

This guide covers the various ways you can file your crypto taxes after purchasing a cointracker plan. The irs uses information reported. Cointracker, on the other hand, generates a irs form 8949 report which focuses on calculating your capital gains. Form 8949 is used to report your cryptocurrency capital gains and losses. Form 8949 sales of capital assets:

What Crypto Tax Forms Should I File?

The irs uses information reported. Form 8949, schedule d, schedule 1, schedule a, schedule b, schedule c, schedule e and form 8275 are the most commonly used irs crypto. Cointracker, on the other hand, generates a irs form 8949 report which focuses on calculating your capital gains. Form 8949 is used to report your cryptocurrency capital gains and losses. This.

CoinTracker Benefits of a crypto tax form generator Cryptopolitan

Form 8949 is used to report your cryptocurrency capital gains and losses. This guide covers the various ways you can file your crypto taxes after purchasing a cointracker plan. Form 8949 sales of capital assets: Cointracker, on the other hand, generates a irs form 8949 report which focuses on calculating your capital gains. Form 8949, schedule d, schedule 1, schedule.

Form 8949 Exception 2 When Electronically Filing Form 1040

Form 8949, schedule d, schedule 1, schedule a, schedule b, schedule c, schedule e and form 8275 are the most commonly used irs crypto. Cointracker, on the other hand, generates a irs form 8949 report which focuses on calculating your capital gains. Form 8949 sales of capital assets: This guide covers the various ways you can file your crypto taxes.

This Guide Covers The Various Ways You Can File Your Crypto Taxes After Purchasing A Cointracker Plan.

Cointracker, on the other hand, generates a irs form 8949 report which focuses on calculating your capital gains. Form 8949 sales of capital assets: The irs uses information reported. Form 8949, schedule d, schedule 1, schedule a, schedule b, schedule c, schedule e and form 8275 are the most commonly used irs crypto.